In this article, we’ll explore how a tax API can help with tax planning. Also, we’ll share some information on the best tax API available in 2022.

The Role Of A Taxes API In Modern Tax Planning Taxes are one of the most important aspects of any country’s economy. The taxes that are collected go toward paying for things like public services, infrastructure, and more. So it’s important that the process of collecting taxes is accurate and efficient.

One way to ensure that taxes are collected accurately is to use a tax API. A tax API is a tool that allows developers to access tax data from a government agency. This data can then be used in applications to help people file their taxes or keep track of their tax obligations.

How Can A Taxes API Help With Tax Planning?

Tax planning is the process of managing your taxes throughout the year in order to minimize your overall tax liability. While there are many different ways to plan your taxes, one of the most effective is to use a tax API.

A tax API allows you to access real-time tax data from the IRS and other government agencies. This data can then be used to make better decisions throughout the year that will help you minimize your overall tax liability.

In addition, a Taxes API can also help you keep track of your tax obligations and ensure that you file your taxes on time. This can save you money and headaches in the long run.

What Is The Best Taxes API Available In 2022?

If you’re looking for a Taxes API, you’re in luck! There are many great options available for both personal and business use.

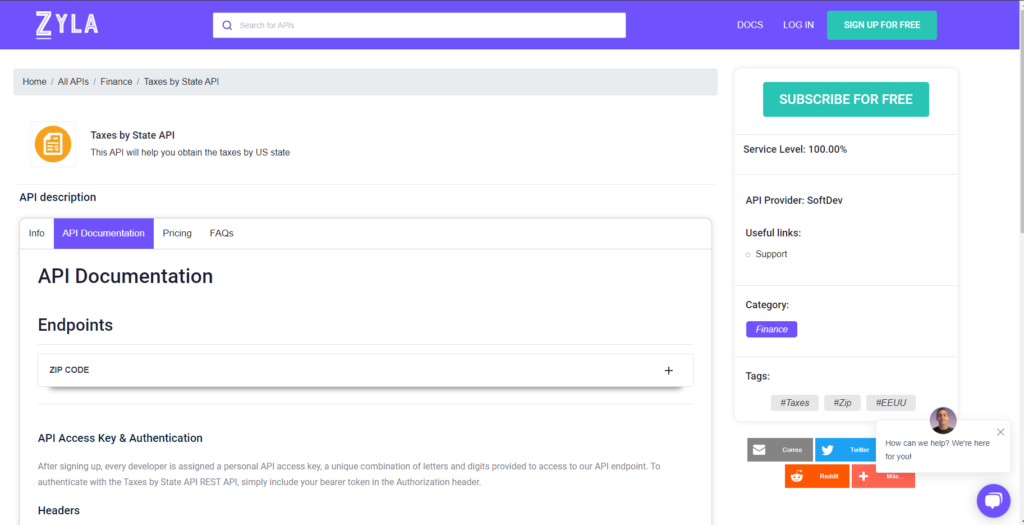

For personal use, we recommend using Taxes By State API. This API provides access to a wide range of personal tax data including income, deductions, and more. It’s easy to use and provides accurate results.

Taxes By State API is also great for businesses that need to access tax data for their customers or employees. It’s easy to use and provides accurate results.

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

If you liked this post and want to know more about this subject, keep reading at: Maximizing Your Tax Deductions With A Taxes By State API