Do you want to know about the top 5 benefits of using a taxes by state API? If so, keep reading to find out!

Taxes are a crucial part of our lives. They are used to fund essential government services, such as education and healthcare. Furthermore, they are used to pay for public infrastructure, such as roads and bridges. But what most people don’t realize is that they also fund programs that help individuals in need, such as food stamps and welfare.

However, many people are unaware of how much they owe in taxes each year; and how much they will be receiving back in refunds. This is due to the fact that taxes are a complex matter that can be difficult to understand. Fortunately, there is an easy solution; and it’s called a tax API!

What Is A Tax API?

An application programming interface (API) for taxes is a tool that allows you to retrieve accurate tax information for any state in the United States. You can use this information to determine how much you owe in taxes; as well as how much you can expect to receive back in refunds.

Furthermore, using this type of API is very simple; and requires no effort from your side! All you need is an Internet connection and a reliable tax API provider. Fortunately, there are many APIs available online; but not all of them are reliable or safe to use. That’s why we recommend using a trustworthy tax API like the one provided by Zyla Labs; since it’s both secure and accurate.

Benefits Of Using Taxes By State API

In addition to being fast and accurate, an API also allows you to retrieve data for any state in the United States; which means that you’ll be able to get the most accurate tax information available.

For example, some benefits of using this API are:

– An examination of the market

– Targeting sales and marketing campaigns

– Locating potential suppliers

– Identifying potential acquisition possibilities

– Information gathering for the purposes of due diligence

Overall, using a taxes by state API is definitely the best way to get up-to-date tax information. So if you’re looking for a reliable and secure API; we recommend using the reliable and secure State Tax Calculator API from Zyla Labs.

How To Get Started With Taxes By State API

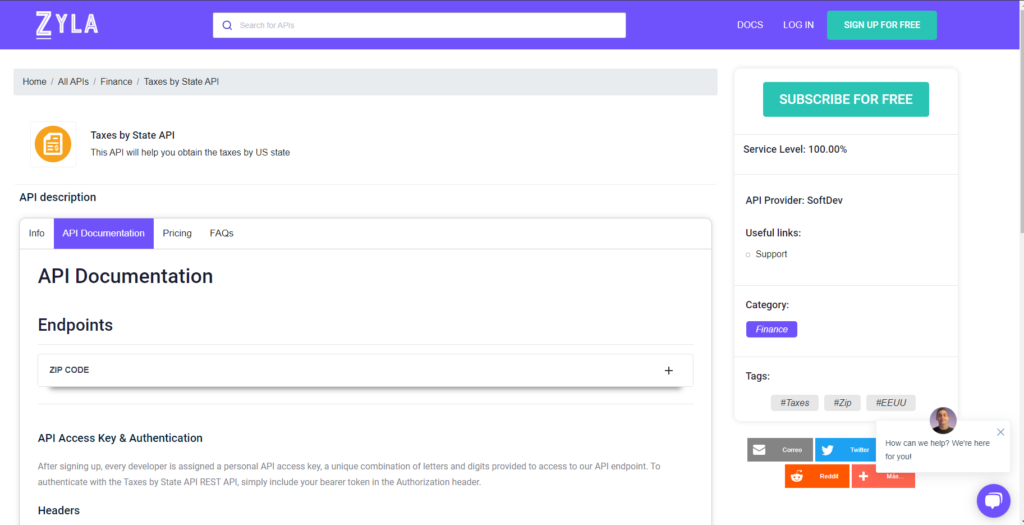

1-Create an account at Zyla Labs website by clicking here.

2-Once your account is created, you’ll receive an access key that you can use to access the State Tax Calculator API.

3-To authenticate your API key, include your bearer token in the Authorization header.

And that’s it! You can now begin using this reliable and secure API!

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related post: Simplify Your Tax Process With The Best API For This