Are you looking for a state tax API with a free trial? You’re in the right place!

In this post, we’ll tell you everything you need to know about state tax APIs and how they can help you save time and money.

First, let’s start with the basics. What is an API?

An API, or application programming interface, is a set of commands and protocols that allow two software systems to communicate with one another. In other words, APIs are a way for two different programs to interact with one another.

How Do State Tax APIs Work?

State tax APIs are a way for businesses to access state tax information. This can be anything from sales tax rates to tax exemptions. These APIs make it easy for businesses to access this information without having to spend time and money collecting it themselves.

There are a few different types of state tax APIs, but the most common is the sales tax API. This type of API allows businesses to access sales tax rates for all 50 states as well as over 15,000 cities and counties across the US.

This information can be used to automatically calculate sales tax on purchases made by customers. This can save businesses a lot of time and money since they won’t have to manually calculate sales tax for each purchase.

Another type of state tax API is the income tax API. This type of API allows businesses to access income tax rates for all 50 states as well as over 15,000 cities and counties across the US.

This information can be used to automatically calculate income tax on employee salaries. This can save businesses a lot of time and money since they won’t have to manually calculate income tax for each employee’s salary.

In addition, there are also other types of state tax APIs that can be used for things like property tax and other taxes that states collect.

So now that you know how state tax APIs work, let’s talk about why they’re so important.

Why Should I Use A Taxes By State API?

There are many reasons why you should use a Taxes By State API. First of all, they are easy to use and integrate into your existing systems. This means that you can start using them quickly and without any hassle.

Also, Taxes By State API is constantly updated with the latest tax rates and laws so you know that you are always getting the most accurate information. This means that you can rest assured that your taxes are always being filed correctly.

Finally, Taxes By State API is affordable and easy to use. They offer both free trial and paid plans so you can choose the one that best suits your needs!

So now that you know everything there is to know about state tax APIs, it’s time for you to try one out!

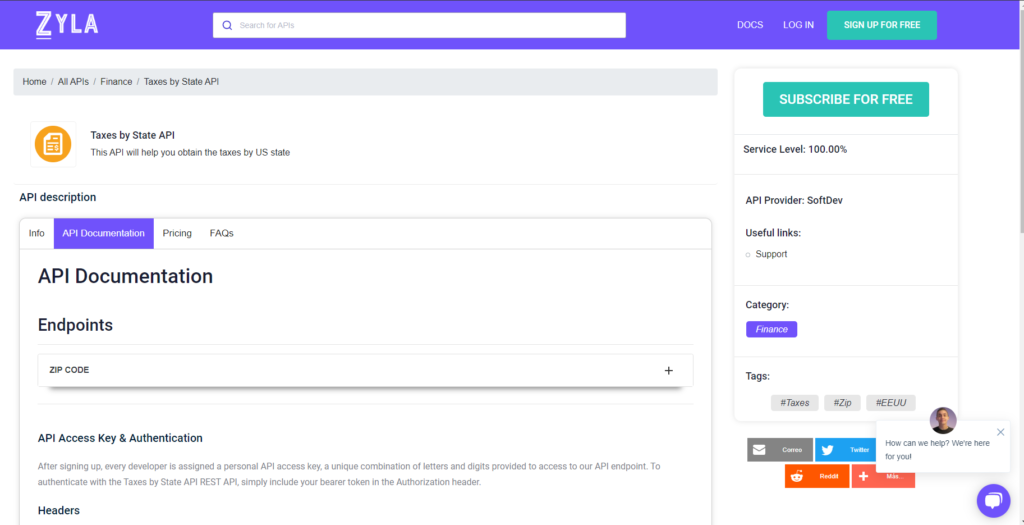

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: A Tax API Simplifies The Way: Check It Out