Do you wish to enhance your state API taxes? We’ve got the greatest one for you! Examine it!

To support their activities, the federal government and each state government collect taxes from individuals and corporations. These are the most prevalent sorts of taxes. The state government is in charge of collecting state taxes. The federal government is in charge of collecting federal taxes.

Taxes are paid by individuals, businesses, and other entities based on a number of reasons. These include their income, the sort of business they own, and their location. Federal taxes are paid to the federal government, whereas state taxes are paid to the state government.

How Do State Tax API Function?

State tax APIs allow enterprises to have access to state tax information. This might range from sales tax rates to tax breaks. These APIs allow enterprises to easily access this information without having to spend time and money gathering it themselves.

There are several types of state tax APIs, the most prevalent of which is the sales tax API. This sort of API gives businesses access to sales tax rates for all 50 states as well as over 15,000 cities and counties across the United States.

This data may be used to automatically compute sales tax on consumer transactions. Businesses will save a lot of time and money since they will not have to manually calculate sales tax for each purchase.

This data may be used to compute income tax on employee pay automatically. Businesses will save time and money since they will no longer have to manually compute income tax for each employee’s compensation.

There are also various sorts of state tax APIs that may be used for things like property tax and other taxes collected by states.

So, now that you understand how state tax APIs function, let’s discuss which is the best on the market.

Why Do We Suggest Taxes By State API?

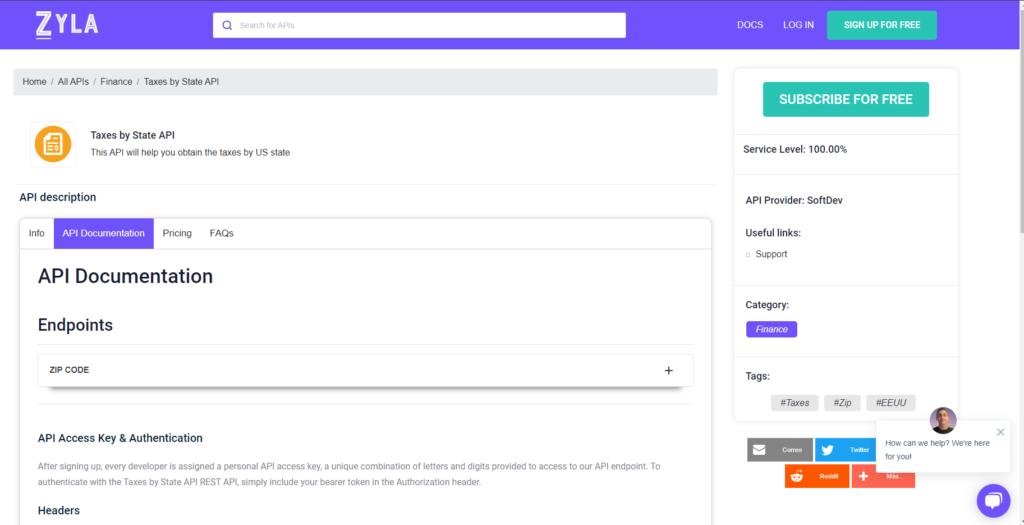

If you need to work with data on state taxes, the Taxes by State API is the best option. This API gathers data from every state in the United States and presents it in an easy-to-use style. This API may be used to learn how much each state collects in taxes and how that money is spent.

This API is ideal for anyone who needs state tax data. This API will fulfill your demands whether you are a data analyst or a member of the marketing team.

The user will be able to access tax rates for each state, as well as other pertinent information such as sales tax exemptions, property tax exemptions, and so on. This data can be utilized by organizations in the United States who need to collect sales tax from customers.

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: How To Know Taxes By State Using An API