Do you want to discover how a taxes by state API might benefit your company? If yes, continue reading!

Tax season is almost approaching, and it’s time to start thinking about how to prepare your company’s taxes. However, you may be asking how a taxes by state API will assist you. If this describes you, you’re in luck! We will discuss how an API may help you with your business taxes in this post. In addition, we’ll expose you to the greatest tax API in 2019! API for State Taxes Taxes are an unavoidable element of doing company.

This is due to the fact that they offer funds for a variety of government programs and services. However, it is critical that businesses pay their fair share of taxes; otherwise, they may face fines or penalties. Calculating taxes, on the other hand, can be a challenging undertaking.

This is owing to the fact that tax rates and legislation differ from state to state. As a result, if a company wants to guarantee that it pays the right amount of taxes, it must have a thorough grasp of these regulations and how they apply to its operations. Fortunately, a tax API can assist with this.

A tax API is a technology that allows companies to instantly access information about tax rates and rules from any state in the United States. They may quickly assess how much tax they must pay on certain commodities or services this way. It will also save them time and money because they will not need to engage a tax expert!

How Can Taxes By State API Benefit Your Company?

There are several advantages to adopting an API for taxes in your business. Here are a few examples:

– Save time on tax computations

– Save money on tax specialists

– Get more precise findings

– Increase operational efficiency

– Improve customer service

– Make more informed tax decisions

– Reduce the possibility of tax fines or audits.

However, not all APIs offered online are trustworthy, therefore it is critical that you select one that provides accurate and trustworthy data.

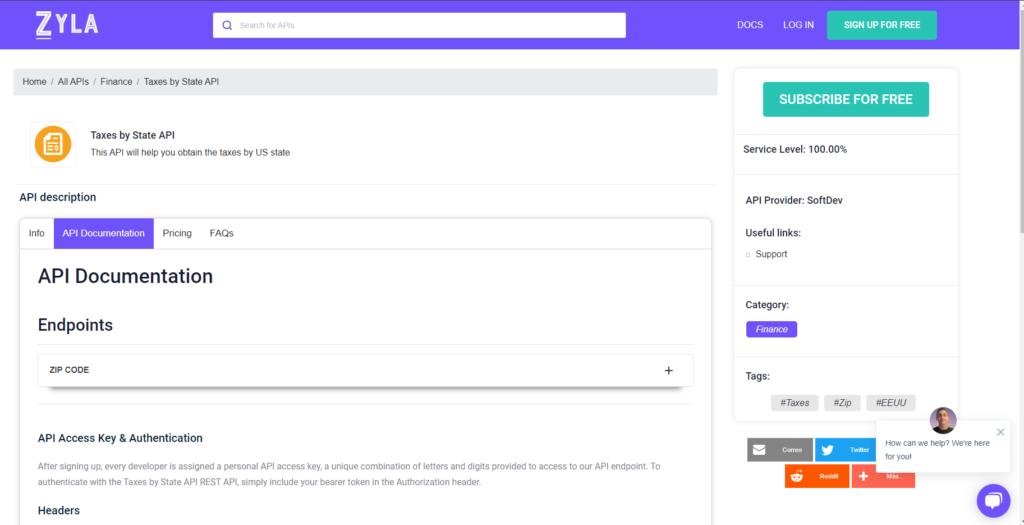

To avoid wasting time on untrustworthy APIs, we recommend going with the most well-known and dependable one: the Taxes By State API. This is a trustworthy tool that can be found at Zyla API Hub.

How Taxes And Income Tax API Can Benefit Your Company!

Taxes By State API offers thorough information on federal and state taxes in the United States. This means you’ll be able to get precise information on your state’s tax regulations as well as federal taxes for your company! You will be able to easily compute your taxes this way!

Furthermore, you may use this API to access this information not just for your own firm, but for any other corporation in the United States! This is because this Taxes By State API pulls data from over 50 million businesses across the United States!

How Can This Tax By State Benefit Your Business?

To begin utilizing this API, you must first create an account on Zyla API Hub and then sign up for an account at Taxes By State API. After that, you will be given an access key to utilize the REST endpoint. With this key, you may begin making requests to the endpoint and receiving the information you require!

Then, before making a request for data, just provide your access key in the Authorization header! You may use this REST API to get information on any firm in the United States, as well as any state!

So don’t wait any longer and start utilizing our tax by state API right away!

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: Optimize Your Calculations With A Taxes By State API