Do you need a state tax information API? We’ve got the greatest one for you!

Every state in the United States levies an income tax. Individuals and corporations pay income taxes on their earnings. This tax is levied on the amount of income earned by an individual or a business over a specific time period.

The flat-rate income tax is the most popular type of income tax. A flat-rate income tax means that all taxpayers, regardless of income level, pay the same tax rate. Another type of income tax is a progressive income tax. A progressive income tax means that higher-income people pay higher tax rates.

In the United States, income taxes are collected by state governments. The federal government levies no income tax. It instead collects income taxes from people and corporations through other taxes such as the federal payroll tax and the corporate income tax.

Why Should I Make Use Of A Tax API?

There are several reasons to utilize a tax API. To begin with, adopting a tax API may save you a significant amount of time and work. Rather of having to manually compute your taxes, a tax API can handle it for you. This can save you a lot of time and effort that you can put to better use.

Using a tax API can also assist guarantee that your taxes are submitted appropriately. You can be confident that your taxes are being submitted correctly and accurately if you use a tax API. This can assist lessen the likelihood of having to pay penalties or fines later on.

Finally, employing a tax API can assist you in saving money. You may prevent making errors while submitting your taxes if you use a tax API. This might assist you avoid having to pay any extra fees or fines.

So, if you want to streamline your tax procedure, we propose using Tax Data API. Tax Data API is a straightforward and user-friendly API that allows you to quickly and easily access tax information for every state in the United States. Tax Data API is also incredibly simple to use and comprehend, making it ideal for anybody who wants to get tax information.

What Is An API?

A programming interface, or API, is a collection of definitions and protocols that software developers may use to connect with software systems.

An API enables two pieces of software to communicate in order to request and get data. This data might range from weather information to sports scores to financial information.

There are several APIs on the market today, but not all of them give reliable and up-to-date data. That’s why we’re here to inform you about the greatest API for state taxes accessible.

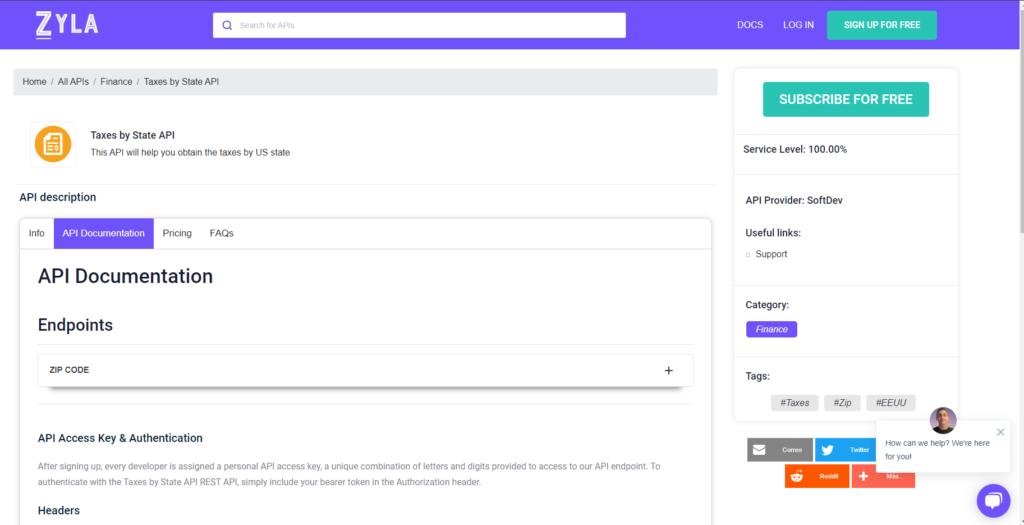

More Info About Taxes By State API

This API is ideal for anyone who needs information on state taxes. Whether you’re a developer seeking this data for an app or website, or you’re just looking for general information on state taxes, this API is for you!

This API is simple to use and has an intuitive UI. Simply create an account and get started!

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

For more information about this API check out this post: How A Taxes By State API Can Help Your Business