Are you new to taxes and need help using an API? You’ve come to the correct location! To learn more about it, see this article.

Individuals and companies in the United States are taxed on all income earned. Federal income tax, state income tax, and municipal income tax are all examples of these taxes. In addition, there are capital gains, inheritance, and property taxes.

Individuals and companies pay income tax to the federal government. The tax owed is determined by the amount of taxable income. Subtracting all permitted deductions from gross income yields taxable income. Some deductions are available to people, while others are available to companies.

Individual and corporate income taxes are collected by the state government. The tax owed is determined by the amount of taxable income. Subtracting all permitted deductions from gross income yields taxable income. Some deductions are available to people, while others are available to companies.

Individual and corporate income taxes are collected by the municipal government. The tax owed is determined by the amount of taxable income. Subtracting all permitted deductions from gross income yields taxable income. Some deductions are available to people, while others are available to companies.

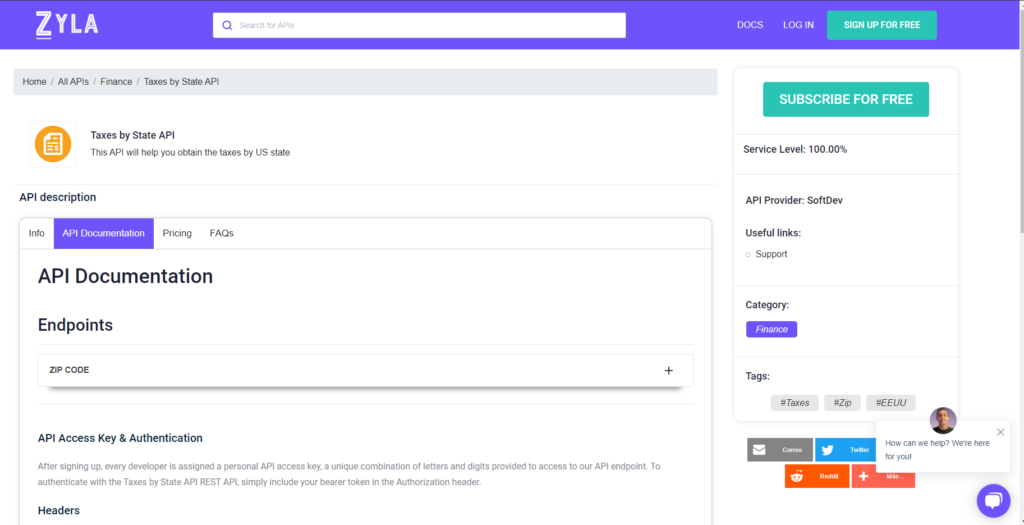

You’ll need an API to assist you to figure out how to calculate these taxes. But which API should you employ? We recommend that you use the Taxes By State API.

Why Use the Taxes By State API?

If you wish to calculate taxes in your app or website, this API is one of the handiest. This is due to the fact that it allows you to compute taxes based on a person’s state, city, and zip code.

This implies that you may calculate taxes based on a person’s location in the United States. This will enable you to deliver a better service to your consumers since they will be able to effortlessly compute their taxes with a single click.

How Do I Make Use Of This Taxes By State API?

To get started with this Taxes by State API, simply join up, obtain an access key, and begin using it. It simply takes a few seconds to sign up, and then you’ll have your unique access key.

After then, all you have to do is start utilizing it. Because it supports REST calls, you may use it in any language.

You may begin utilizing it immediately after signing up because there are no more steps or paperwork to complete. Simply insert the state, city, or zip code into the supplied box and then make the API request.

This Taxes by State API allows you to compute each form of tax that exists in the United States, ensuring that your calculations are accurate and will not cause any difficulties in the future.

To utilize it, you must first do the following:

1- Navigate to Taxes by State API and click the “Subscribe for free” option to begin utilizing the API.

2- You will be issued your unique API key after registering in Zyla API Hub. You will be able to utilize, connect, and administer APIs using this one-of-a-kind combination of numbers and characters!

3- Depending on what you’re looking for, use different API endpoints.

4- Once you’ve found your required endpoint, perform the API request by selecting the “run” button and seeing the results on your screen.

Related Post: There Is Tax Free In The USA?find Out With A Taxes By State API