Your Tax Situation: What Is It And How To Know It With An API

Taxes are a subject that is often avoided by many people. But there are good reasons for it, as we are going to explain in this article. If you’ve never paid or know what taxes are for, you should know that they are one of the ways a country generates income to finance public services such as education, health, security, infrastructure, and others. The payment of taxes is a legal obligation of every citizen of a country.

In general, the government taxes the income of individuals and corporations. The income tax is a percentage of the income that a person or legal entity receives during a year. The amount of tax due is calculated by deducting the expenses that can be deducted from the taxable income, such as the mortgage interest paid on the house or the health insurance paid by the taxpayer. It is also important to note that the tax rate varies depending on how much income you receive in a year and what type of income it is. In general, higher-income earners pay more taxes than lower-income earners.

The tax rate varies depending on how much income you receive in a year and what type of income it is. In general, higher-income earners pay more taxes than lower-income earners.In addition to income tax, there are other types of taxes such as sales tax (VAT), which is paid on certain goods or services, such as those related to housing or transportation. Also, there are taxes on goods such as tobacco and alcohol. And finally, there are taxes on corporate profits.

Taxes APIs: What Are They And Why Are They Important

A way to make the calculation of your taxes a bit easier is through the use of a Tax Calculator API. An Application Programming Interface (API) is a set of commands that allow two software systems to communicate with one another. In other words, an API enables two different systems to easily transfer data with themselves. An API for tax calculation can allow you to access all kinds of tax-related information from federal, state, and local governments across the United States more easily and fast.

But which API can do that? Instead of having to search online for one, you should use The Taxes API. It’s easy to use and can greatly provide a reliable and accurate source of information for taxes. It works instantly by returning you a response based on a few required parameters. Here you can see a display of The Taxes API main page. In here you can subscribe and see a more detailed view on what exactly it can offer you.

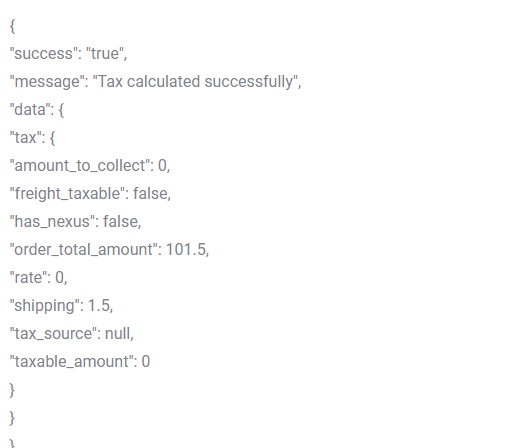

The Taxes API values precision, speed and being reliable to give you accurate information for you to use in your taxes calculation and estimations. To be brief; the API receives data about your country, state, zip code and other details; it then returns a response which has information on tax calculation and amount. You can again check the API fully from just the main page.

Why Choose This Tax API To Help you Know Your Tax Situation

The Taxes API is a fine and great site to work around the tedious process of tax payment. Many people find it a frustrating and loathsome process but this API can help you cut short the time and effort put into it. The site works excellently to provide you a good amount of information to help with your taxes. Furthermore, the simple design and user-friendly look will help you get the hang of the API in no time at all.

Another thing to consider is, The Taxes API is easy to both use and integrate into other existing systems; making it a great tool for developers who want to make their processes faster and easier. So if you need a reliable way to know your tax situation; The Taxes API will be your best option; it’s easy to use and available at an affordable price with many options to choose from in the pricing page. Don’t miss out on those deals!

Lastly, to make use of it, follow this short guide:

- Go to The Taxes API and simply click on the button “Subscribe for free” to get an account on the site.

- After signing up in Zyla API Hub, you’ll be given your personal API Access Key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage the API’s endpoints

- Employ the different API endpoints depending on what you are looking for and don’t forget to fill the asked parameters.

- With all that done, make the API call by pressing the button “run” and see the results on your screen.

Start using The Taxes API today and lear all you need to know about your tax situation in seconds!