Are you a retired person and need a tool to make your job easier when calculating your taxes? We bring you a magnificent solution in this post! read it to the end!

The United States provides its residents with a wide range of retirement alternatives. The regular pension plan and the 401(k) plan are the most popular (k).

However, the tax burden on these plans may grow in 2023. This is why it is critical to be aware of the Ideal Taxes By State API, which will allow you to know ahead of time what taxes to pay.

Pension Plans In The United States

In the United States, both companies and employees can select from a variety of retirement programs. The 401(k) and pension plans are the most prevalent.

A 401(k) is a sort of retirement plan that allows you to save money for your future. Employers can contribute money to their workers’ accounts, which they can subsequently invest in a range of different financial products under this sort of plan. Before taxes are imposed, the contribution is taken from the employee’s salary. To put it another way, they are tax-free until withdrawn in retirement.

A pension plan, on the other hand, is a sort of retirement plan that pays employees a certain sum of money at the conclusion of their job. This amount is generally determined by a variety of criteria, such as length of work or income.

Pension schemes are typically supported by both company and employee contributions. However, both forms of donations may be taxed as income beginning in 2023.

This raises the tax burden on both companies and employees, perhaps discouraging them from contributing to retirement programs.

API Taxes By State: Ideal For Retirees

With this information regarding retirement plans in 2023, it is clear that it is critical to understand what taxes will be levied and how much they will be. In this manner, you will be able to select an Ideal Taxes By State API that will save you money while also assisting you in managing your tax load.

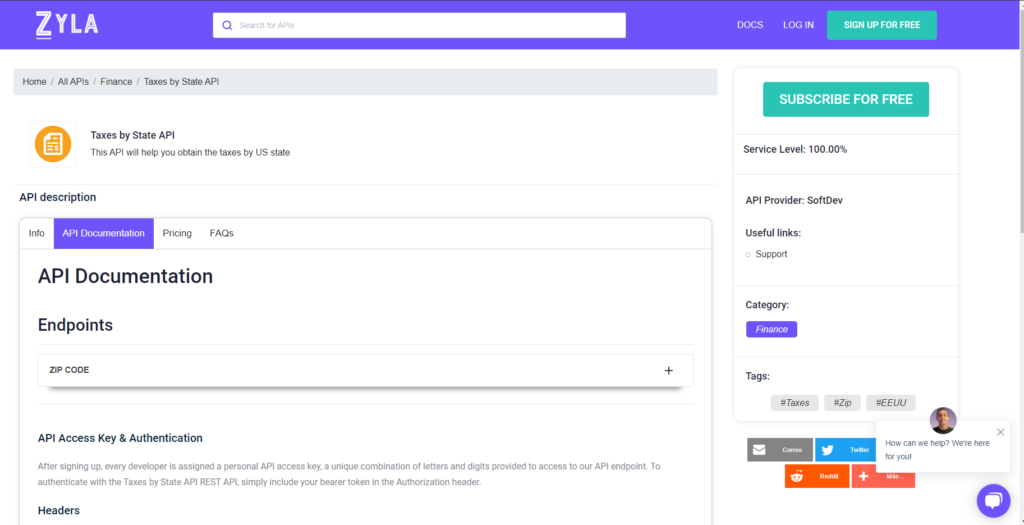

This is why we propose that you use the Taxes by State API. You will be able to find all of the information you want on taxes by state using this tool. You may also use it to learn about any state in the country.

API For Taxes By State

Taxes by State API is an application programming interface that provides precise information on state taxes in the United States. This data may be used to determine taxes for any state or city in the United States.

This API also allows you to compare states and determine which states have lower taxes, allowing you to pick them as your new place of residence if you are searching for cheaper taxes. This API also includes information on sales tax, property tax, income tax, and other sorts of taxes.

This API is great for retirees who wish to relocate from one state to another since it will supply them with all of the relevant tax information by state so that they can make an informed decision about where they want to live.

To utilize it, you must first do the following:

1- Navigate to Taxes By State API and click the “Subscribe for free” option to begin utilizing the API.

2- You will be issued your unique API key after registering in Zyla API Hub. You will be able to utilize, connect, and administer APIs using this one-of-a-kind combination of numbers and characters!

3- Depending on what you’re looking for, use different API endpoints.

4- Once you’ve reached your desired destination, make the API by pressing the button “run” and see the results on your screen.

Related Post: The Benefits Of A Taxes API For Self-Employed Workers