Is it necessary for you to pay taxes? Are you concerned about getting it right? We’ve got an API for you! More information may be found in this article.

As you are probably aware, the great bulk of taxes is paid to the state. Income tax, value-added tax (VAT), corporation tax, and so on are examples. You might be wondering how much tax you have to pay. The amount of taxes you pay is determined by a number of factors, including your income, the goods and services you purchase, and the state in which you live.

If you operate a small business or work as a freelancer, you may be curious about how taxes affect your earnings. The amount of taxes you pay is determined by several factors, including your income, the products and services you purchase, and the state in which you live.

Because they do not receive a tax return, many individuals are unaware of how much tax they pay. Americans, unlike inhabitants of other countries, receive a tax return from the government at the end of the year. People who earn less money over the year generally receive a government rebate.

Why Are Taxes Required?

Individuals and corporations pay taxes to the government in order to support public initiatives and services. Public education, road maintenance, healthcare, and other amenities are among the initiatives and services offered.

The government also utilizes tax income to fund its activities, including as government employee wages and military expenses.

How Do We Work Out Our Taxes?

Income tax is computed on your gross income, which is before any deductions or exemptions. To calculate your taxable income, subtract any permitted deductions from your gross income.

Sales tax is levied by shops when they sell products and services to customers. The state government then collects the sales tax and uses it for different reasons.

How Do We Work Out Our Taxes? Using The Taxes By State API!

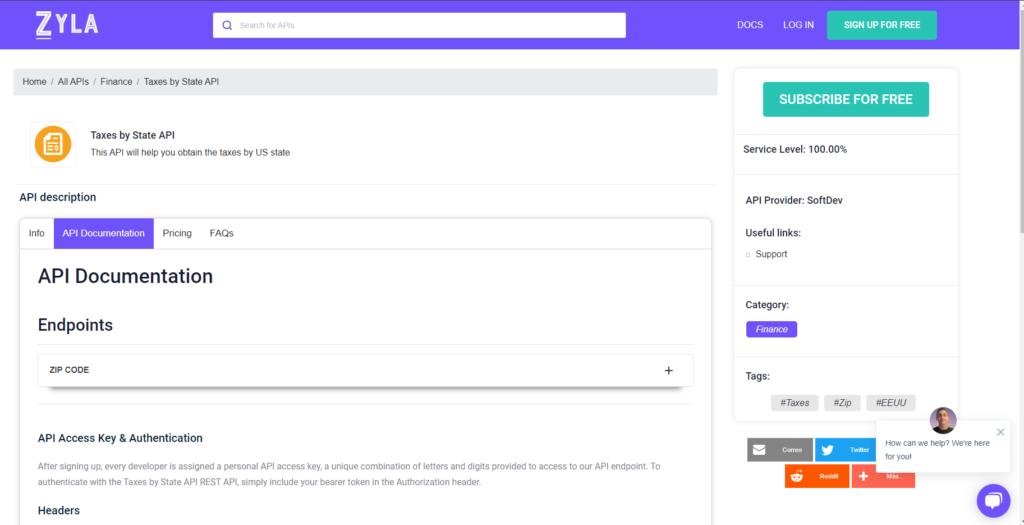

If you want to become more tax-savvy, the Taxes by State API is what you need. You will be able to learn everything about your taxes thanks to this API. And with this information, you will be able to do your taxes with ease.

You will be able to learn everything about your taxes thanks to the Taxes by State API. You can choose from the several choices provided by this API to obtain all of the information you want about your taxes by state. You may choose the sort of income, whether it’s wage or non-wage, whether it’s self-employment or not, whether it’s a pension or not, and so on.

You may also select whether you wish to access this information by zip code or state code. If neither of those alternatives works for you, you may also access it by city name.

And don’t worry about any constraints since Taxes by State API offers a variety of plans that will allow you to use this API as many times as you like; thus whether you need to use it once or every day, whatever suits your needs.

To Make Use Of This API, You Must First

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: A Taxes By State API To Find The Information You Need