Do you need to know how to get sales tax for any US state? In this article, we will tell you how an API can help you with that.

Sales tax is a tax paid on the purchase of goods and services. It is typically paid by the consumer at the time of purchase and is collected by the seller. The amount of sales tax paid is a percentage of the purchase price and varies by state.

It is one of the most important taxes for most businesses, as it represents a significant portion of their revenue. In addition, it is one of the taxes paid by consumers, which means that it is difficult to avoid or reduce. Therefore, it is important to know how to calculate sales tax and ensure that your business complies with all applicable laws.

How To Get Sales Tax For Any US State?

The amount of sales tax that a business must charge is determined by the location where the sale occurs and the type of product or service being sold. There are three main types of sales taxes:

– A specific sales tax applies to a specific good or service (for example, clothing).

– A general sales tax applies to most goods and services (for example, retail goods).

– An exempt sales tax does not apply to any goods or services (for example, food).

The location where a sale occurs determines the rate at which a business must charge sales tax. This rate is known as the sales tax rate.

Simplify Your Tax Workflow With A Taxes By State API

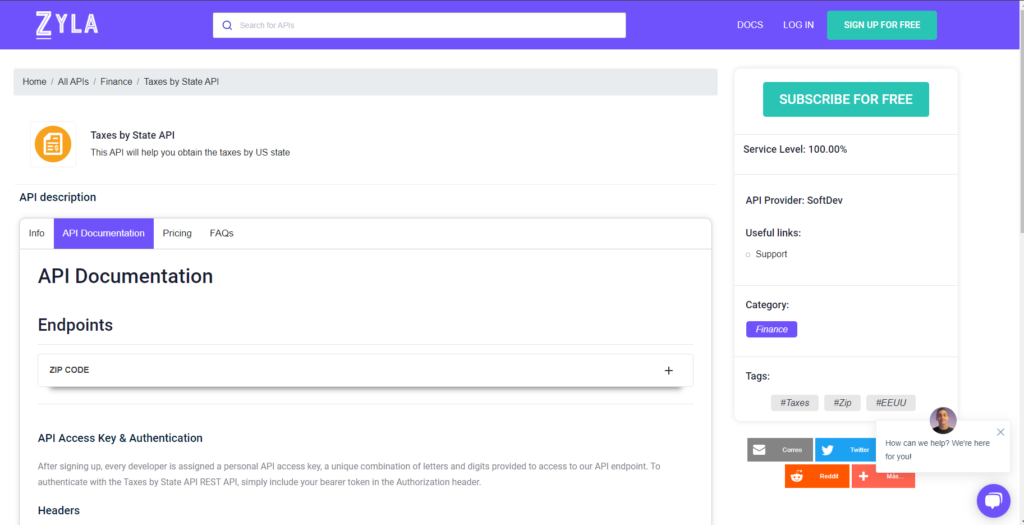

If you want to streamline your tax workflow, you should consider using an API for state taxes. Users of this application programming interface can access state tax rates and other information from the United States.

Because APIs are often used by organizations, they may help them save time and money by allowing them to access existing data rather than acquiring it from start. This is why, for those who wish to streamline their tax routine, adopting an API for taxes may be really beneficial.

So, if you need an API to assist you to streamline your tax procedure, we propose utilizing an API for state taxes. A Taxes By State API is a tool that lets users get state tax rates and other data from the United States.

Furthermore, because this form of API is typically simple to use, it will not need much work on your behalf! We advocate utilizing this Taxes API to further simplify your tax workflow: Taxes By State API.

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.+

Related Post: The Top 5 Benefits Of Using A Taxes By State API