Are you looking for a way to make vital transactions? If so, you should use this routing number API!

The exchange of goods, services, or information between two or more persons is referred to as a “transaction.” In economics, a transaction is defined as the exchange of products, while in commerce, a transaction is defined as the exchange of goods and services for money.

In other terms, a transaction is an occurrence in which one party exchanges something of value for something else of worth from another party. Any firm relies heavily on transactions. Transactions, whether they involve a sale, a purchase, or an exchange of services, are crucial to every organization.

However, tracking these transactions is a challenge for many businesses. They may have numerous transactions per day and frequently deal with multiple currencies, which may account for this. Fortunately, there are technologies out there that can make it simple and effective for businesses to keep track of their transactions. For domestic transactions, a routing number indicates the financial institution and its location in the United States (or Canada). The branch number and account number used by the financial institution to complete the transaction are also identified. Your monthly statement and any other notifications pertaining to your account will be sent to you by your bank using the routing number associated with your account. For organizations that must conduct crucial transactions, having access to this information is crucial.

There are fortunately numerous ways to obtain this information, however not all of them are risk-free and secure. It is not advised to utilize search engines because it is simple to find false information. We advise using an API if you wish to obtain trustworthy data.

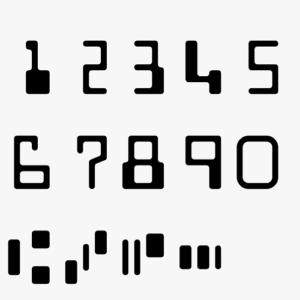

Furthermore, routing numbers are necessary to set up direct deposit, automatically deducted loan payments, and recurring transfers like bill payments. Instead of manually encoding the data, an API can give a data checker more quickly and easily. As a result, you don’t need to wait for the banks to formally answer in order to get this information immediately and in real-time. A routing number, a nine-digit identity, is used to identify a bank or credit union during a transaction. It intends to accelerate and reorganize banking sector operations. Each bank has been given a distinct number. Banks can be identified from one another while having the same names because of their unique routing numbers.

Routing Number Bank Lookup API

A Routing Transit Number API is used for a variety of reasons, many of which are closely tied to the significance of a routing number. In many banking procedures, the most recent is employed. To demonstrate their relevance, the following is a small list. Your company will be able to automate the payment of bills online, the transfer of money via wire transfer, the requirement for an immediate transfer of my paycheck, the implementation of direct deposit for government benefits like Social Security, the transfer of money across borders, and other possibilities.

Considering that automation is the key to current business process optimization, ZylaLabs created the service with simplicity in mind. The API may be used to perform bank details validation at each stage of your business process with just a few lines of code. You can utilize the code samples that our developers have created to quickly get started with the API. You can avoid refused customer payments by incorporating this ACH bank information API into your business. It is beneficial to check the provider’s routing number before completing any transactions. Also, it enables the identification of the bank to pinpoint the account’s location. Finally, it will give you the option of calling the bank and using additional information to validate what you need.