Do you wish to use an API to get data about a bank? We’ll explain how to accomplish it to you in this article.

Banks conduct payments and transfers between financial institutions using their routing numbers. The financial institution’s routing number is also used to identify a particular account.

Routing numbers are often located in the lower-right or lower-left corner of a deposit slip or a cheque. The majority of bank statements also include them, and you may find them by searching for “routing number” on the bank’s website. You can use this information to confirm a bank’s legitimacy, make deposits or withdrawals from an account, or ask a financial institution for account statements. Additionally, you can use it to pay bills with your debit card or send money between banks via wire transfer.

Additionally, you may find out information about a bank in the US Federal Reserve System using the routing number. The address, phone number, website, and other particulars of the bank may be included in this data.

Additionally, routing numbers are required for the creation of direct deposit, loan payments made automatically, and recurring transfers like bill payments. An API can be used to deliver a data checker more quickly and easily than by manually encoding the data. As a result, you can obtain this information instantly and in real-time without having to wait for the banks to formally respond.

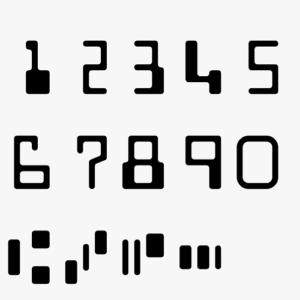

A routing number, a nine-digit identity, is used to identify a bank or credit union during a transaction. It intends to accelerate and reorganize banking sector operations. Each bank has been given a distinct number. Banks can be identified from one another while having the same names because to their unique routing numbers.

In the financial sector, APIs provide unmatched flexibility. Procedures may be made simpler and financial transactions may be made simpler with the use of these technologies. Your organization will benefit greatly from using banking APIs. You can ensure that the financial transactions of your clients are quick and secure by integrating them. Buyers can show that their funds are available for usage, and sellers will be paid by a respectable bank.

Routing Number Bank Lookup API

The Routing Number Bank Lookup API from Zyla Labs is a trustworthy source of bank data. You can handle payments, approve payments, and manage your funds thanks to this API. Adding this product to your company is simpler than it would first appear. Nevertheless, we will provide you a detailed explanation of this API service so that you may grasp it.

By using this API, bank-to-bank money transfers are made easier. The system will provide you all the bank information when you have selected your preferred payment method and entered your routing number. You can use this API to verify the routing number, account location, and other bank details before completing the transaction. This bank information API is unrestricted aside from the 100,000 monthly request cap for individual plans. But this issue can be rectified by moving to a personalized plan. Users can obtain bank information thanks to the Zyla Labs-created Routing Transit Number API. These could include details such as the name of the bank, the account number, the location, and more. If the routing number information is wrong, missing, or insufficient, your monthly expenses rise by thousands of dollars. ACH Bank information APIs can be utilized to manage bank accounts and ensure prompt payment. The Routing Number Bank Lookup API offers a comprehensive routing number verification search engine. Your team may utilize our route number validation tool with ease. They can examine accounts, check routing numbers, and verify account owners by validating the data.