Using a tax API is one method to ensure that you’re getting the most out of your taxes. A tax API is a tool that allows you to obtain current tax information. This might be useful if you need to submit your taxes or ensure that you’re paying the correct amount.

This post will describe how a tax API works and how you may benefit from one.

What Exactly Is A Tax API And How Does It Function?

A tax API is a technology that allows developers to access the IRS (IRS is the revenue service for the federal government of the United States, responsible for collecting federal taxes and enforcing the Internal Revenue Code) tax data. This information may then be utilized in applications or websites to give users with up-to-date tax information. The API retrieves data from the IRS database by connecting to it. It then displays this information to the user in an easy-to-understand style.

There are numerous sorts of tax APIs, but they all function in the same way. They let developers access IRS tax data and utilize it in their programs or websites. This is beneficial to both developers and end users.

Why Do We Suggest Tax APIs?

Tax APIs can be beneficial to end users since they allow them to readily access tax data without having to wait for an update from their tax software supplier. Furthermore, Tax APIs are often updated with the most recent tax information, so end users may be confident that they are receiving the most correct data possible.

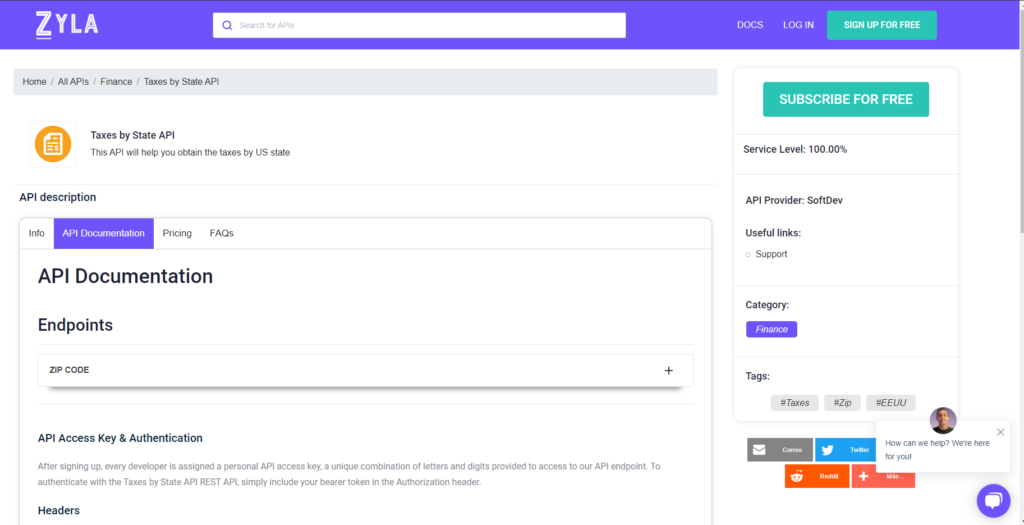

How Can We Make Use Of The Taxes By State API?

It’s simple to get started with Taxes by State API! Simply follow the instructions below:

1- After you create your account, you will be given an API key.

2- Include your bearer token in the Authorization header to authenticate with this Taxes by State API.

3- Send a request to the US Taxes endpoint.

That’s all there is to it! The Taxes by State API will generate all of the information you want in a matter of minutes.

To use it, you must first complete the following steps:

1- Go to Taxes by State API and select “Subscribe for free” to begin using the API.

2- After enrolling with Zyla API Hub, you will be given your own API key. Using this one-of-a-kind combination of numbers and characters, you will be able to use, connect, and administer APIs!

3- Use different API endpoints depending on what you’re looking for.

4- After you’ve located your desired endpoint, make the API call by clicking the “run” button and viewing the results on your screen.

If you loved this article and want to learn more, continue reading at: A Beginner’s Guide To Using A Taxes By State API