Do you want to learn more about how to protect your customers? A credit card validator API can also help you improve the experience; keep reading!

By verifying credit card information, you can ensure that customers can make purchases without having to enter their information multiple times. This can help reduce customer frustration and increase customer satisfaction. When it comes to keeping your business safe, a credit card validator API can be invaluable. It can help protect them from fraud and malicious activity, and it can also help improve the customer experience.

By using a credit card validator API, you can ensure that your customers are protected and that their purchases are safe and secure. Ultimately, a credit card validator API can be an invaluable asset for any business that accepts credit cards.

By validating customers’ information and verifying the accuracy of their credit card data, you can ensure that your customers are safe and that their purchases are secure. In addition, you can improve the customer experience by reducing the amount of time it takes to process payments. By using a credit card validator API, you can keep your business safe and secure while also providing your customers with a better shopping experience.

But.. What’s an API?

API stands for “Application Programming Interface.” In the context of APIs, the word “application” refers to any software with a distinct function. An interface can be thought of as a contract of service between two applications. This contract defines how the two communicate with each other using requests and responses.

how works a Credit Car validation API?

This API is intended to help you spot fraudulent credit card transactions. Start verifying, validating, and checking all information on credit and debit cards just using BIN numbers.

The user will send the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number) to get the full details.

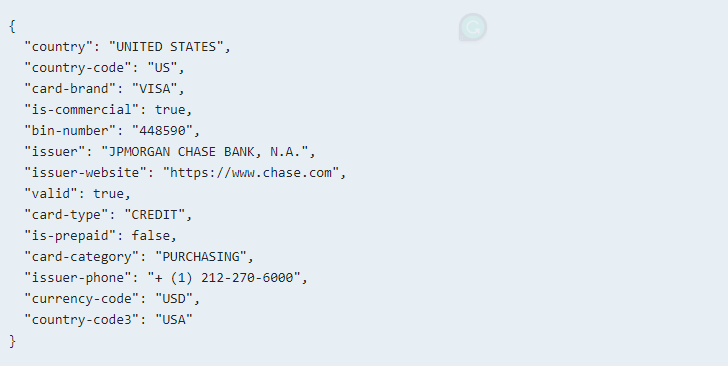

You have to provide a BIN (Bank Identification Number)—the first 6 digits of a credit or debit card—to receive the full details of this BIN or IIN in JSON format.

You will receive the card’s validity, whether it’s VISA or MasterCard, the name of the issuing bank, and the card’s issuing location.

This is an example of an API response:

What are the most common uses of this API?

This API is ideal for those who are wanting to implement a payment gateway on their pages. This API will help with those purposes because it will recognize if the card is invalid.

This is also helpful to recognize the issuing bank or entity. So if you have special offers with a specific bank, you will be able to authorize the transaction or not.

To make use of it, you must first:

1- Go to Credit Card Validator – BIN Checker API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3: Employ the different API endpoints depending on what you are looking for.

4: Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.