Taxes are a charge for many people. However, you can reduce your tax load by using a tax API. This API will help you to find the best tax deduction for your state. You can also use it to find out what taxes you have to pay. If you want to learn more about this API, keep reading!

Every country in the globe has its own unique income tax system. The various taxes paid to the government, as well as their proportion, are established by the country and are frequently impacted by its economic status.

Taxes are often utilized for other purposes, such as environmental conservation or industry assistance. Because it is easier for enterprises to maintain track of their revenues, the bulk of taxes are collected from businesses rather than individuals.

What Is A Tax API?

A tax API is an application programming interface that allows you to access tax data. This data can be used to make better decisions about your finances and your taxes. There are many different types of tax APIs; however, the most common type is the state tax API. This API allows you to access state tax information and make better decisions about your state taxes.

Why Should You Use A Tax API?

There are many reasons why you should use a tax API.

First, a tax API is easy to use and integrate into your existing systems and processes. Second, a tax API is constantly updated with the latest tax information, so you can be sure that you are getting the most accurate information possible. And third, a tax API is affordable and easy to integrate into your existing systems and processes. So if you are looking for a way to save time and money on your taxes, a tax API is the way to go!

If you want to learn more about this issue and give better explanations to your clients or coworkers, you should utilize an API like Taxes APIs, which will allow you to perform all of these calculations in a matter of seconds without having to waste time or money on hiring an accountant.

In this scenario, we recommend utilizing Tax APIs if you wish to utilize this sort of API because it provides a wealth of information about taxes in many nations. This is a really valuable tool for individuals who wish to assist clients in better understanding how taxes operate in various nations.

To make use of it, you must first:

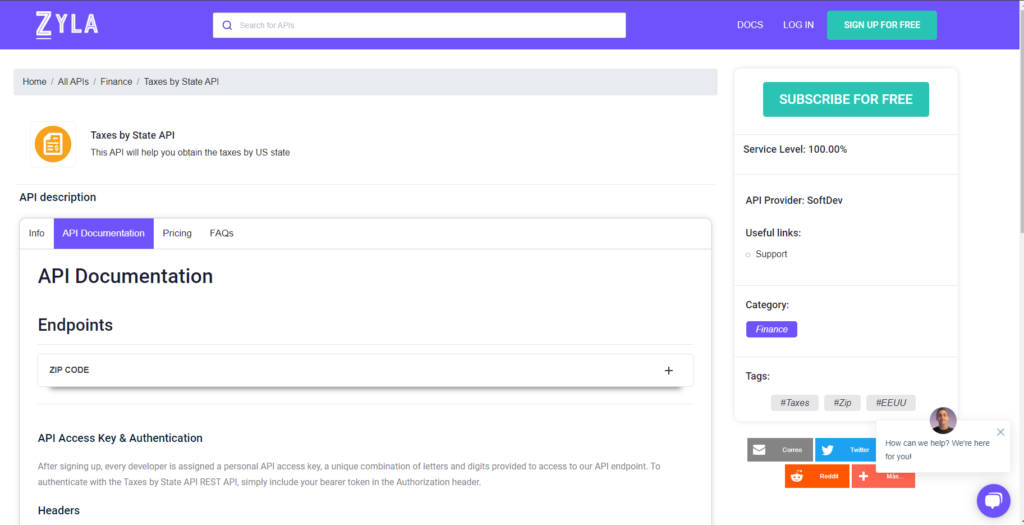

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: Simplifying Your Tax Filing With A Taxes API