Do you require a taxes by state API to improve your calculations? In this post, we’ll show you how to achieve that using a taxes by state API.

Because each state in the United States has its own tax structure, the rate at which income tax is levied differs from one state to the next. This implies that if you do business in more than one state, you must figure out how much income tax each state demands.

The federal government of the United States levies an income tax as well. This is referred to as the federal income tax. The federal tax is dependent on your income and is the same no matter where you live in the country. The federal tax is determined using a method that takes your entire income, deductions, and exemptions into consideration.

How To Optimize Calculating Your Taxes Using An API

As previously stated, there are several forms of taxes in the United States. As a result, if you wish to optimize your calculations with a taxes by state API, this will be quite useful.

Taxation by state API will provide you with all the information you need regarding taxes in each state. This will help you understand how much tax each state requires and how much money you will have to pay to each one.

Furthermore, a taxes by state API will tell you how much money you’ll have left after paying all of your taxes. This allows you to prepare your budget for the coming year and ensure that your firm has the funds to pay all taxes.

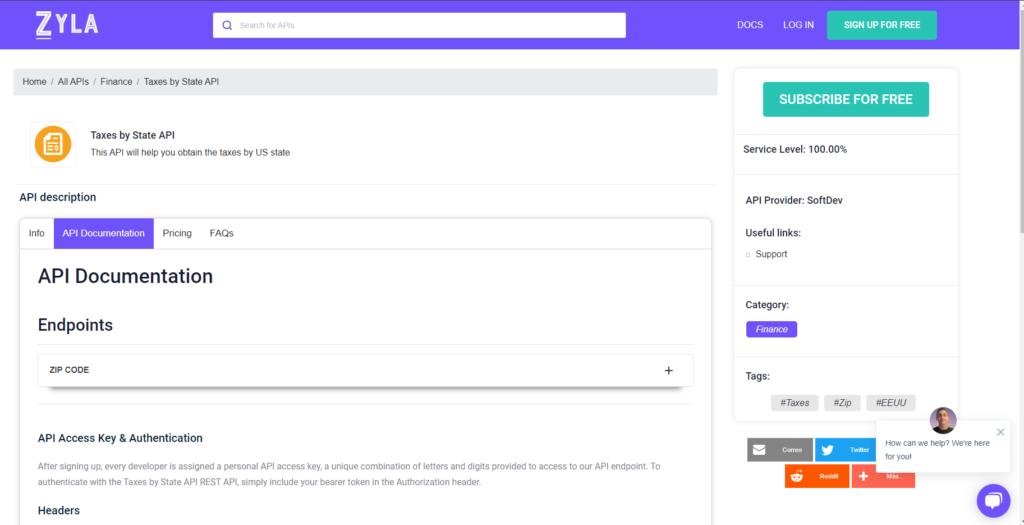

As a result, if you need to improve your calculations using an API, we offer Taxes By State API. You will be able to obtain complete tax information in each state in the United States with this sophisticated application. Furthermore, it is incredibly simple to use and can be utilized in virtually any programming language.

Follow These Simple Methods To Improve Your Computations With Taxes By State API In Only A Few Clicks:

– Go to the home page of the Taxes By State API.

– Under the quick link to get started, click the Subscribe button.

– Check the box at the bottom of the page to confirm you are not a robot.

– Your API access token for State Tax Amounts will be presented.

Simply put it in place of the real secret key to test it.

API For Tax Data By State

You may get information on every US state’s sales and use tax, as well as other taxes that apply to most businesses, by using our Taxes By State API. Using this API, you may obtain information on all 50 states in the United States.

This API offers sales and uses tax rates for every state in the United States. It also contains information on additional taxes that may apply to your company, such as those on salaries and capital gains. You would be provided a list of all relevant taxes in USD, as well as the USD equivalent for each tax.

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: A Taxes By State API To Make It Easier