Are You Looking For Tax Filing Software to facilitate your work? Then check out this post, to know everything about Taxes API!

The Function of a Tax API in Modern Tax Planning Taxation is a critical component of every country’s economy. The taxes collected are used to fund things like public services, infrastructure, and other things. As a result, it is critical that the tax collection procedure is precise and efficient.

Using a tax API is one approach to verify that taxes are collected correctly. A tax API is a mechanism that enables developers to obtain tax information from a government agency. This information may subsequently be utilized in programs that assist consumers in filing their taxes or keeping track of their tax obligations.

How An API May Assist Me In Paying My Taxes?

The act of controlling your taxes throughout the year in order to minimize your overall tax burden is known as tax planning. While there are several methods for planning your taxes, one of the most successful is to utilize a tax API.

A tax API gives you real-time access to tax data from the IRS and other government authorities. This information may then be utilized to make smarter decisions throughout the year, allowing you to reduce your overall tax liability.

Furthermore, a Taxes API may assist you in keeping track of your tax responsibilities and ensuring that you file your taxes on time. In the long term, this can save you money and problems.

If you don’t want to spend hours calculating your taxes or if you don’t want to make any mistakes, then you need Tax APIs.

First Things First: What Is An API?

An application programming interface (API) is a connection between two software programs that allow data to be exchanged. APIs allow software developers to construct apps by supplying data or functionality from other programs rather than having to design them from scratch.

This API returns data in JSON format, making it simple to incorporate into your current systems and applications. You may also simply alter the data returned to match your unique requirements.

So How Can APIs Help Me Prepare My taxes?

Well, there are actually quite a few ways! First off, APIs can give you access to all sorts of data that can make tax preparation easier. For example, you can use an API to get up-to-date stock prices for your investments, which can help you avoid having to estimate their value.

APIs can also help you automate some parts of tax preparation; for example, some APIs allow you to automatically fill out certain forms based on the information in your account.

So now that we know what APIs are and how they can help us prepare our taxes; let’s look at some of the best APIs for tax preparation.

Taxes API: Get Your Taxes Done Right!

If you’re looking for a fast, easy way to get your make use of it, you must first:

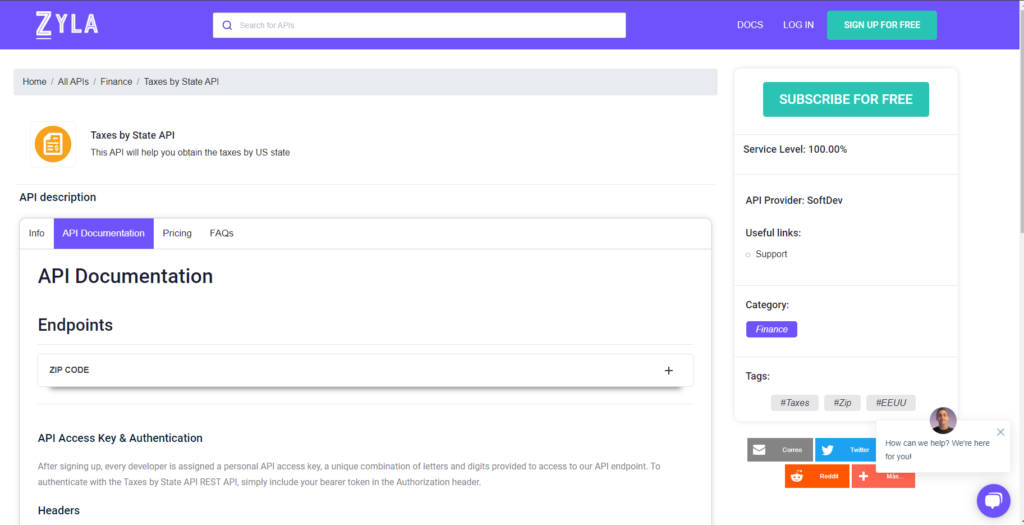

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: The Benefits Of A Taxes API For Freelancers