Do you want to speed up your tax calculation? In this post, we talk about a free API to help you with this issue!

Taxes are a type of imposition applied on individuals, corporations, and other legal entities based on their income and wealth. The government dictates the type of taxes that these different entities are obliged to pay. In principle, taxes serve as a base for the government to finance many public services or areas for the sake of the country’s well being.

Some taxes that you may come across are income tax, value-added tax (VAT), or corporate tax. The value-added tax (VAT) is a consumption tax that is levied at each stage of the production process. The VAT is charged by businesses to consumers when they buy goods or services.

Corporate taxes are imposed on profits earned by corporations. Individuals pay taxes on their income after deductions and exemptions. Income tax is based on the amount of income earned by an individual or corporation in a given year. Income tax is calculated annually by individuals or corporations.

The amount of tax owed depends on how much income an individual has earned in a year. Some taxes are deductible from taxable income, while others are not. The amount of taxes owed can be reduced by deductions and exemptions depending on the situation.

How Can I FInd Out My Tax Rate Fast?

Either if you work in a company related to taxes or you are a common citizen, you will know how important it is to calculate them properly. This means that you should estimate and study them correctly, or else you could face legal repercussions. For this, one might feel troubled since tax calculation is hard and stressful. A good option for anyone to use is an Application Programming Interface (API) that serves as a tax calculator. For this The Taxes API is a great example.

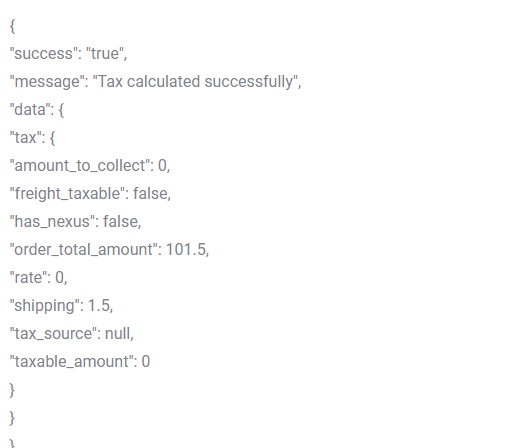

The Taxes API from Zyla API Hub is a great site that you or anyone can use to get access to tax data. The API, like most, works with an input-to-input system in which you input data for the API to work and later you receive back a response. In the case of The Taxes API, you can find out the value of a tax applied to a specific transaction by providing details like country, city, zip-code and others.

Here you can see what the mentioned response of The Taxes API looks like. This information will appear on your screen just a few seconds later after you’ve made the call to the API.

Why Use This Taxes Calculation API?

For starters, The Taxes API will help you save time since it works with top speed. In addition, the site works greatly for not only common users and tax-payers but for companies and corporations. A business can easily use this API to improve upon their accountability and learn how much tax they are paying with their products. Another example is that the site of The Taxes API can serve as a good tool for accountants or tax professionals that often work with this type of calculation process.

How To Use It

Read this brief guide to know how you can use the site today!

- Go to The Taxes API and press the “Subscribe for free” box to sign up for an account.

- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs endpoints.

- Employ the different API endpoints depending on what you are looking for.

- Once you meet your needed endpoint, be sure to provide all the data needed, for the case of tax calculation you’ll need: country, state, zip-code, amount of the order and shipping value.

- When all of this is done, send the request, wait a few seconds and you’ll get back all the data on how much is being taxed.

Get to use The Taxes API today to calculate your taxes with great speed!

Slow down! here is a related post for you: Want To Calculate Your Tax Rate With A Free API?