Do you need to use a state tax API? We’ll go over everything you need to know in this post.

The federal government levies taxes on the items and services you buy. The money is then used to support its activities. The federal government then distributes a portion of the funds to the states. This money is used by the states to support their own activities.

The states also collect taxes on the items and services you buy. The money is then used to finance their own activities. Finally, the state returns some of the money to the federal government. This money is used to finance the federal government’s operations.

To put it another way, taxes are levied at both the federal and state levels. The federal government collects national taxes and then redistributes part of the proceeds to the states. In turn, the states collect state taxes and remit a portion of the proceeds to the federal government.

What Exactly Is An API?

An API is a computer interface that allows two pieces of software to interact with one another. Developers use APIs to create new apps or improve existing ones by providing access to data or functionality that would otherwise be difficult or impossible to get.

Most significantly, APIs enable users to quickly and easily interface with numerous systems and applications. It’s like having a key that opens all kinds of doors.

How Do You Use An API For Taxes?

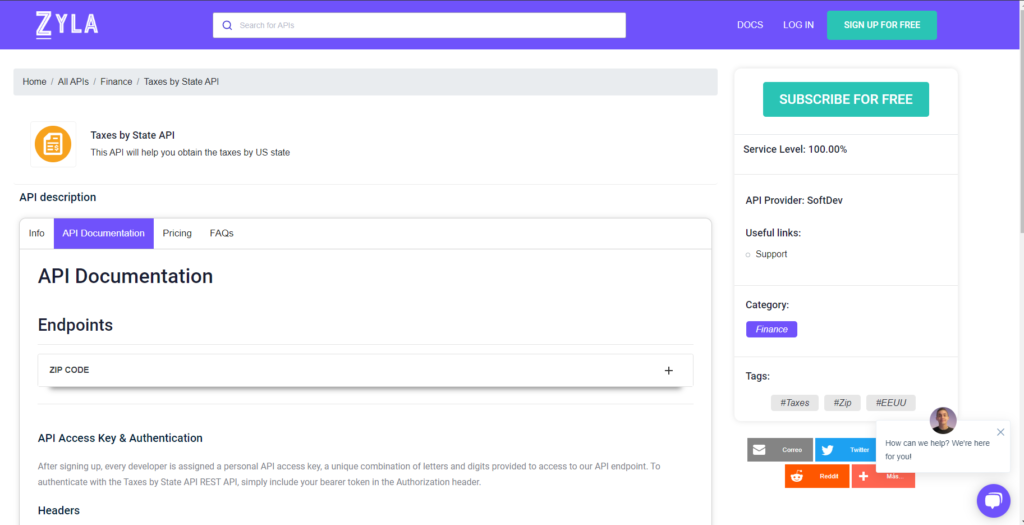

First and foremost, you should be aware that an API for taxes may assist you in a variety of ways. It can help you save time and money while also making your job simpler. If you’re searching for an API for taxes, we propose the Taxes By State API.

The Taxes By State API is an excellent resource for obtaining tax information from all 50 states in the United States. This implies that you may learn about sales tax rates, property tax rates, and other forms of taxes.

Taxes By State API makes it straightforward to obtain this information by offering a simple and user-friendly interface. This information may then be used to assist you with your business or taxes.

How To Make Use Of This Tax Data API

To begin, establish an account on the Zyla Labs website by completing these steps:

– When joining up, confirm your email address by clicking the link supplied to it.

– Once your account has been created, you may begin making requests.

– In the state field, type the state abbreviation.

– In the population field, type “pop”.

– Finally, in the GDP (Current USD) column, type “GDP”.

That’s all there is to it! All of this information will be delivered to you in JSON format in seconds!

To utilize it, you must first do the following:

1- Navigate to Taxes by State API and click the “Subscribe for free” option to begin utilizing the API.

2- You will be issued your unique API key after registering in Zyla API Hub. You will be able to utilize, connect, and administer APIs using this one-of-a-kind combination of numbers and characters!

3- Depending on what you’re looking for, use different API endpoints.

4- Once you’ve found your required endpoint, perform the API request by selecting the “run” button and viewing the results on your screen.

Related Post: An Ideal Taxes By State API For Retirees In 2023