Are you a freelancer? If so, you may be wondering how you can simplify your tax obligations. In this article, we’ll show you how an API can help you with that. So, keep reading to find out more about the benefits of having one of these.

The North American Industry Classification System (NAICS) is the standard used by federal statistical agencies to classify entity establishments for the purpose of collecting, analyzing, and publishing statistical data related to the economics of US businesses.

Taxes are necessary for the government to function and provide public services. But they can also be extremely complex and time-consuming. This is especially true for freelancers, who often have to deal with a lot of paperwork and calculations. That’s why many people look for ways to simplify their taxes and make the process easier. One of the best ways to do this is by using a tax API.

These are tools that connect to government databases and provide information about taxes. They can help you calculate your taxes, file your tax returns, and even find deductions that you may be eligible for. Tax APIs can save you a lot of time and effort, so they are a great option for freelancers who are looking for a way to simplify their taxes. In this article, we’ll give you an overview of how they work and some of their benefits.

How Can A Taxes API Simplify Your Freelancer Taxes? One of the biggest benefits of using a tax API is that it can help you save time and effort when calculating your taxes. This is because the API can automatically retrieve relevant tax information from government databases and calculate your taxes based on this information. This means that you won’t have to spend time gathering documentation or making calculations yourself; the API will do it for you automatically.

This can save you a lot of time, which you can then use on other tasks or projects. Another benefit of using a tax API is that it can help you avoid mistakes when calculating your taxes. This is because an API can provide accurate information about tax deductions and other tax-related issues. This way, you won’t have to worry about making mistakes when calculating your taxes; the API will do all the work for you!

How Can You Benefit From An Taxes API?

If you’re a freelancer, then chances are you’re looking for ways to simplify your taxes. One way to do this is by using a tax API; these are tools that connect to government databases and provide information about taxes. They can help you calculate your taxes, file your tax returns, and find deductions that you may be eligible for.

In addition to simplifying your taxes, using a tax API is also a good way to stay up-to-date on tax laws; this way, you’ll know what to expect when filing your taxes each year!

So if you’re looking for a way to simplify your taxes, a tax API is a great option to consider.

To make use of it, you must first:

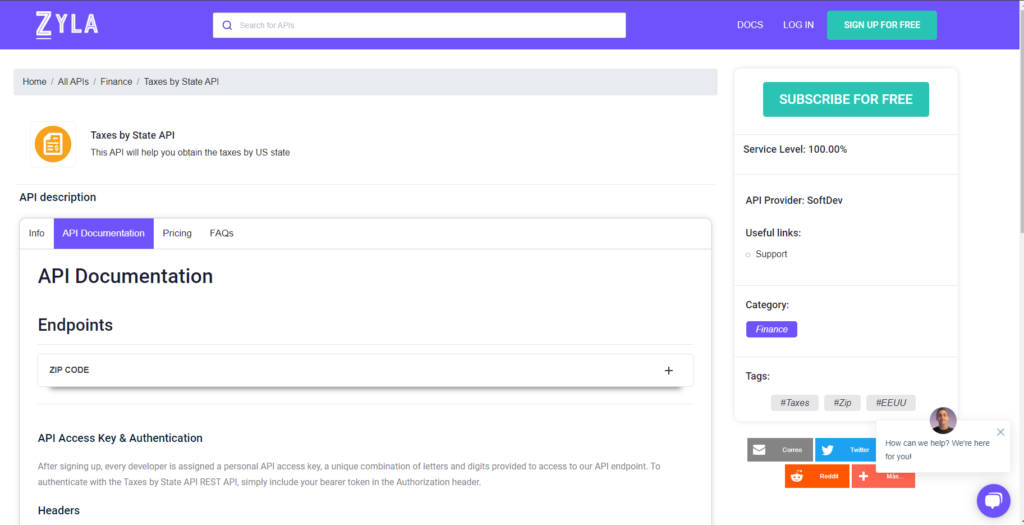

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

If you found this article interesting and want to learn more about how a tax API can benefit freelancers; then keep reading: The Benefits Of Using A Taxes API For Your Tax Preparation