If you work for yourself, taxes are an everyday occurrence. We understand how difficult it is to keep track of everything, which is why we propose using a Taxes API to assist you with this chore. In this post, we will discuss the advantages of utilizing one as well as introduce you to the finest one on the market.

Self-employed individuals must deal with taxes on a regular basis. They must maintain track of their income and spending, submit their taxes, and settle any outstanding balances. This may be a time-consuming and challenging procedure, particularly if you are unfamiliar with taxes or accounting.

The Advantages Of Using A Tax API

Using a Taxes API can help you save both time and money. It can assist you in avoiding errors by verifying that your calculations are correct. It might also assist you in avoiding fines by ensuring that your taxes are filed on time.

Because it is simple to use and comprehend, a Taxes API can help you avoid employing an accountant or tax specialist. It is also relatively inexpensive and accessible to everyone with an internet connection.

Taxes APIs are a crucial tool for self-employed individuals. They may save you time and money while ensuring that your taxes are properly submitted. Furthermore, they may assist you in avoiding fines by ensuring that your taxes are submitted on time. There are several APIs accessible, so it is critical to select one that is both dependable and simple to use. We’ll expose you to the greatest Taxes API on the market in this post.

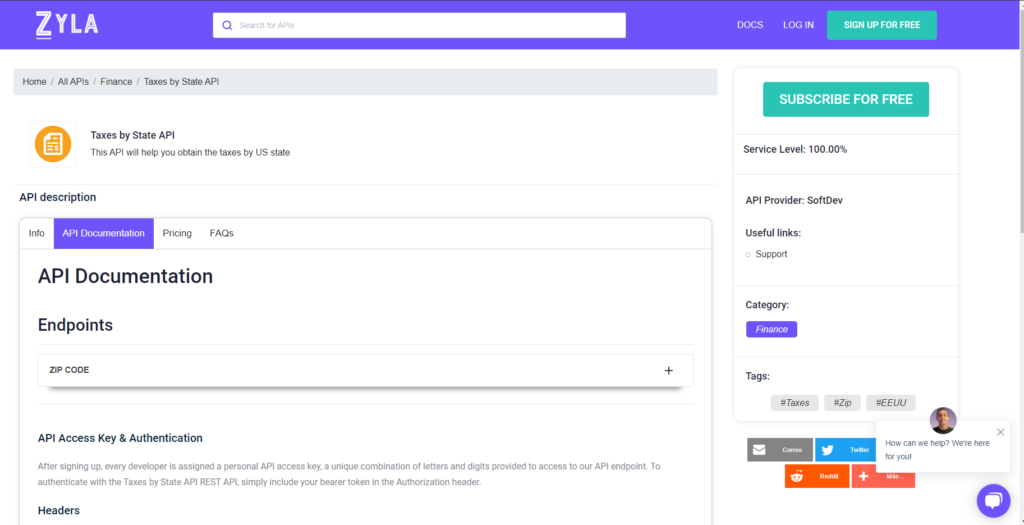

Taxes By State API: The Most Comprehensive Tax Information API Available

Taxes By State API is a well-known tax information API that delivers full tax data from all 50 US states. This API is simple to use and comprehend, making it ideal for both novice and expert developers. It is also continually updated with the most recent tax information, ensuring that you are always receiving the most up-to-date information.

You may use the Taxes By State API to quickly and simply access tax information by state or county. You may also lookup information by zip code or latitude/longitude coordinates. This API returns data such as income tax, sales tax, property tax, and so on.

How To Apply It

The steps below will teach you how to get started with the Taxes By State API:

1- After you establish an account, you will be given an API key.

2- To authenticate, include your bearer token in the Authorization header.

3- Submit your request.

That’s all there is to it! You will receive a response with all accessible tax information for the place selected in your request.

To use it, you must first complete the following steps:

1- Go to Taxes by State API and select “Subscribe for free” to begin using the API.

2- After enrolling with Zyla API Hub, you will be given your own API key. Using this one-of-a-kind combination of numbers and characters, you will be able to use, connect, and administer APIs!

3- Use different API endpoints depending on what you’re looking for.

4- After you’ve located your desired endpoint, make the API call by clicking the “run” button and viewing the results on your screen.

Related Post: A Taxes By State API: Simplify Your Tax Return