Do you need to use a Taxes API for your Tax preparation? You should continue reading this post, to know how to use this API!

The income tax system of each country in the world has its own peculiarities. The different taxes that are paid to the government and their percentage are determined by the country and are often influenced by its economic situation.

The government’s ability to collect taxes from its citizens is an essential part of its function as a controller of the nation’s finances. The government must have sufficient income to be able to provide essential services to its citizens, such as healthcare and education, as well as to run the nation’s infrastructure and maintain a military force.

Taxes are collected by the federal government, state governments, and local governments. These taxes are collected in three different ways: income tax, sales tax, and property tax. The first two types of taxes are levied on the individual, while the last one is paid by the individual or business that owns a property.

Taxes are also used for other reasons, such as for environmental conservation or to support specific industries. The majority of taxes are collected from businesses rather than individuals because it is simpler for businesses to keep track of their earnings.

Use An Taxes API

If you want to learn more about this topic and want to provide better explanations to your clients or colleagues at work; you should use an API like Taxes APIs; which will allow you to make all these calculations in just a few seconds; without having to waste time or money on hiring an accountant.

In this case, we want to recommend using Tax APIs if you want to use this type of API; since it offers all kinds of information about taxes in different countries. This is a very useful tool for those who want to help customers understand better how taxes work in different countries.

About Taxes APIs

Taxes APIs are one of the most popular among developers and programmers who work with large companies; because it allows them to calculate taxes in just a few seconds; without having to waste time doing it manually.

This API will allow you to calculate all types of taxes automatically. This means that you will not have to waste time calculating each type of tax separately, but instead, you will be able to do it all at once. In addition; it supports more than 40 different programming languages so that you can easily incorporate it into your website or application.

To make use of it, you must first:

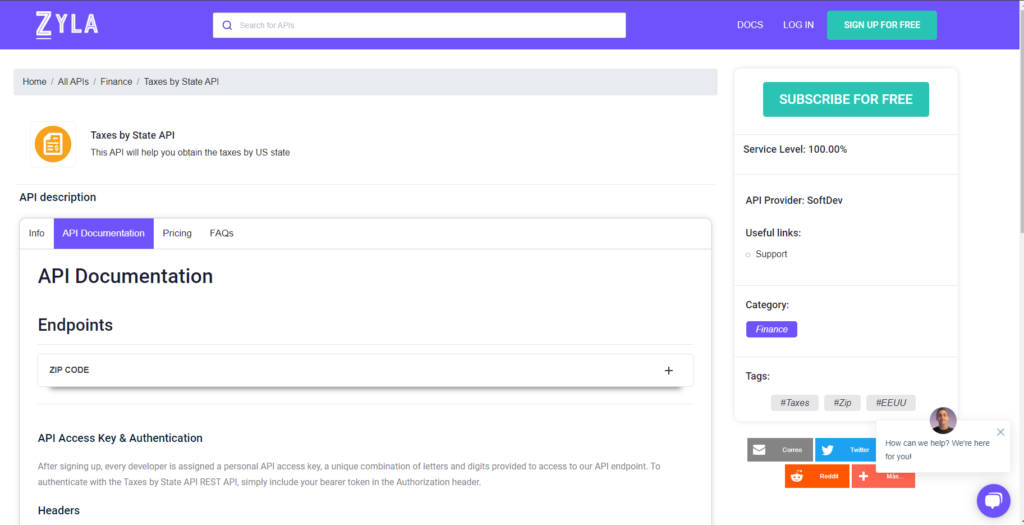

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.