Do you need to prepare your taxes but don’t know where to begin? You’ve arrived at the correct location! We’ll teach you how to use this new tax API to do your taxes in just a few minutes.

Taxes are an annoyance, but they are a necessary evil. They contribute to the funding of vital initiatives and programs, as well as the operation of our government. However, paying taxes may be a tremendous pain. That’s why we’re thrilled to present you with our brand-new tax API, which will make submitting your taxes a snap.

This new tax API is the most efficient approach to filing taxes in 2023. It’s quick, simple, and precise. And, best of all, it’s completely free to use! So, if you need to file your taxes, make sure to check out this new tax API.

But What If I Want To Do My Own Taxes?

If you wish to file your own taxes, this new tax API is still an excellent choice. Simply submit your W-2 document, and the API will calculate your taxes instantly. You may then compare the findings to the statistics provided by the IRS to ensure that everything is right.

So, what are you holding out for? Begin using this new tax API right away to save time and money!

What Exactly Is The Taxes By State API?

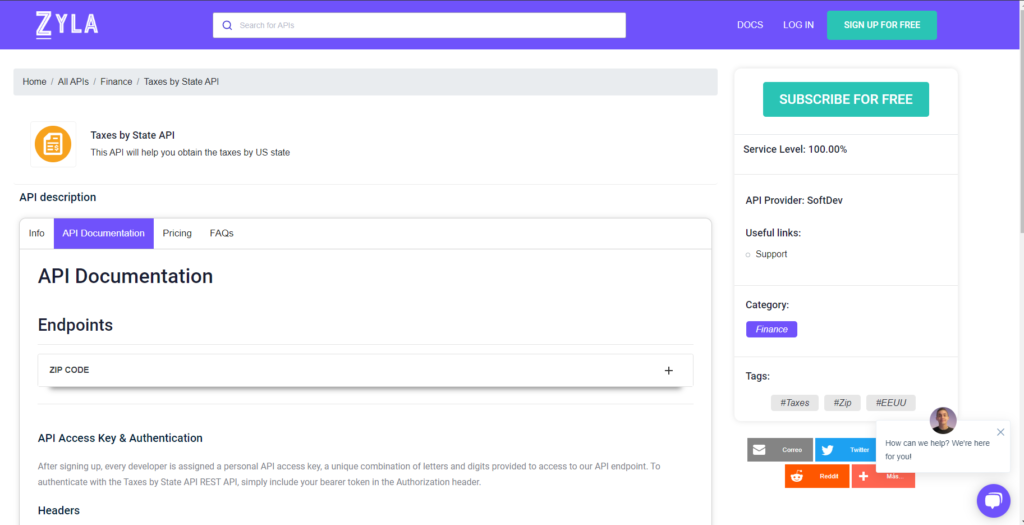

Taxes By State API is a wonderful place to start with tax data since it is simple to use and delivers trustworthy data. If you require tax information, here is a fantastic place to start.

How Does This API Function?

The first step is to open a Zyla Labs Inc. account. This is simple; after you create an account, you will be issued a unique API key that will allow you to access the Taxes By State API RESTful web service.

Include your bearer token in the Authorization header to authenticate with the RESTful Taxes By State API.

What is the most popular use for this tax information?

This RESTful web API provides a range of valuable tax data by zip code characteristics. One of the most popular applications is establishing average income tax rates by zip code, which may be used by banks or other financial organizations to estimate suitable lending rates for different areas.

To make use of it, you must first:

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: Taxes By State API: Everything You Need To Know