Do you wish to transfer money but lack the necessary knowledge? We’ll explain how to achieve so in this article utilizing an ABA lookup API.

A mechanism that enables money transfers between banks is the Automated Clearing House (ACH) network. This system enables a wide range of transactions, including debit card purchases, bill payments, direct deposits, and withdrawals. The ACH network is not only safe, but also incredibly productive. Transfers are processed immediately and usually take one business day to complete. This is why sending money between banks using it is growing in popularity. The ABA number of the bank where the recipient’s account is held must first be obtained if you wish to transmit money over the ACH network. If you don’t know the recipient’s account’s bank name or address, this may be challenging. An API is useful in situations like that.

Automation in the banking sector may not have been a problem ten or thirty years ago, but it certainly is now in the age of digital technology. The banking industry is meeting customer expectations and removing its overly burdensome system by introducing open banking solutions. Bank APIs are utilized by the banking sector to provide swift and trustworthy financial transactions. A great example of it is the Routing Transit Numbers APIs. If the routing number details are incorrect or incomplete, money could be paid or received by the wrong account. Similar to that, this might cost a business thousands of dollars. Routing numbers should always be verified, especially when a financial transaction necessitates their disclosure. This can, however, take some time if done manually.

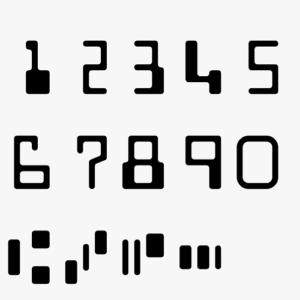

During a transaction, a bank or credit union is identified by its nine-digit routing number. It makes an effort to speed up and streamline banking activities. A certain number has been allocated to each bank. Despite having the identical names, banks can be distinguished from one another because of their distinctive routing numbers. Routing numbers are also required to set up automatic loan payments, direct deposit, and recurring transfers like bill payments. An API can provide a data checker faster and easier than manually encoding the data. As a result, you can obtain this information instantly and in real-time without having to wait for the banks to formally respond.

Routing Number Bank Lookup API

The Routing Number Bank Lookup API provides access to information about the routing number. Since it is a straightforward bank information API, all you need to submit is the chosen payment method and the route transit code. On this system, payments can be made using wire transfers and ACH. In general, it makes it simpler for financial institutions to exchange money. It first confirms a provider’s route number before processing any transaction. It also enables the ability to pinpoint the bank and account’s location. Not to mention, you can verify any necessary information over the phone using additional bank data.

To enable secure transactions and avoid irksome payment rejections, routing transit number APIs are increasingly frequently employed. Any company would gain a lot from utilizing Zyla Labs’ Routing Number Bank Lookup API. It will assist you in more ways than only automating the route number verification procedure to deliver trustworthy fund transfers. You’ll also be able to save money and time. The importance of a routing number is closely related to the reasons for employing a Routing Transit Number API. The newest is used in a number of banking processes.