Do you want to simplify your tax workflow? If the answer is yes, you should use a taxes by state API!

You may be aware that taxes are a necessary part of life. We must pay them to fund the services that we enjoy; such as roads, schools, and hospitals. However, paying taxes can be a nightmare for most people. This is due to the fact that most people have to deal with complex paperwork and calculations.

Fortunately, there is a way to simplify this process. If you use an API for taxes, you’ll be able to automate much of the work involved in calculating tax rates; and filing your taxes. So, if you’re looking for a way to simplify your tax workflow; we recommend using a state tax API.

What Is A Taxes By State API?

An application programming interface (API) is a tool that allows two programs to communicate with one another. This means that an API enables two different programs to exchange data in order to facilitate processes or tasks that would otherwise be difficult or impossible.

In other words, an API allows its users to access data from other programs or websites; without needing to know how this data is stored or formatted. This enables developers to create applications more quickly and efficiently.

Additionally, since APIs are often used by businesses; they can also help businesses save time and money by allowing them to use existing data rather than collecting it from scratch. This is why using an API for taxes can be very helpful for individuals who want to simplify their tax workflow.

So, if you’re looking for an API that can help you simplify your tax workflow; we recommend using an API for state taxes. A state tax API is a tool that allows its users to retrieve state tax rates and other information from the United States. This means that it can help you calculate the taxes you owe on your income more quickly and easily.

Furthermore, since this type of API is usually easy-to-use; it won’t take much effort on your part! To simplify your tax workflow even more, we recommend using this particular state tax API: State Taxes API.

Simplify Your Tax Workflow With An API For State Taxes

If you’re looking for a way to simplify your tax workflow, then you should consider using an API for state taxes. This type of application programming interface allows its users to retrieve state tax rates and other information from the United States.

Since APIs are often used by businesses; they can also help businesses save time and money by allowing them to use existing data rather than collecting it from scratch. This is why using an API for taxes can be very helpful for individuals who want to simplify their tax workflow.

So, if you’re looking for an API that can help you simplify your tax workflow; we recommend using an API for state taxes. A state tax API is a tool that allows its users to retrieve state tax rates and other information from the United States.

Furthermore, since this type of API is usually easy-to-use; it won’t take much effort on your part! To simplify your tax workflow even more, we recommend using this particular state tax API: State Taxes API.

To make use of it, you must first:

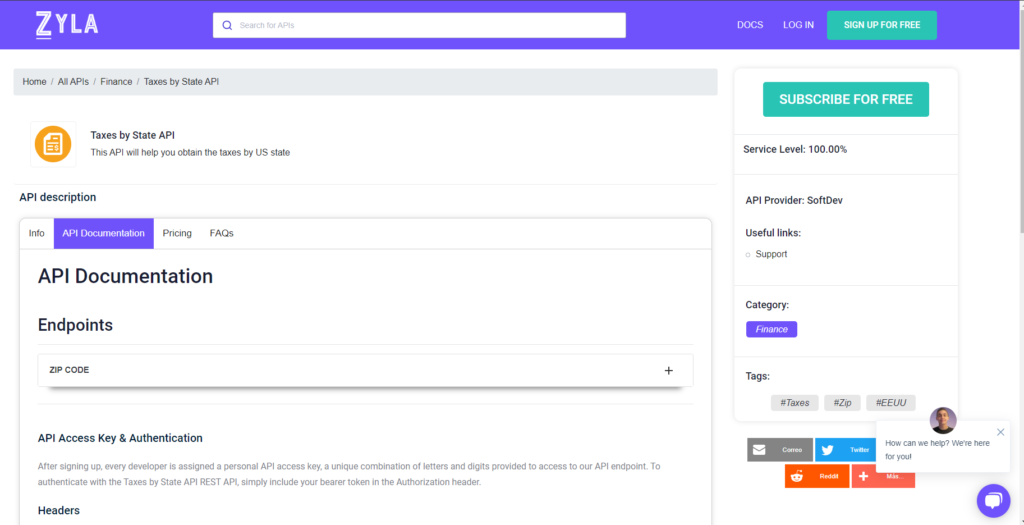

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related post: Using A Taxes By State API To Simplify Your Tax Process