Accomplish you need to confirm bank accounts but are unsure how to do it? You can accomplish this by using a bank number API. So continue reading if this interests you!

We are all aware that in order to access a service or make an online purchase, we must supply information about our bank accounts. This is so they can identify us and let us conduct transactions, which information is given to them by the bank where we hold our money.

But some people use fictitious bank information to defraud others or for illicit activities like money laundering. Because of this, you should confirm that the bank account details are accurate and legitimate if you are a business owner. You can stop illegal activity on your website or app in this way.

Verifying bank accounts should therefore be one of your first steps when starting up an online business. By doing this, you can be sure that the money entering your company is legitimate and not counterfeit. Using a bank account validator API is the most effective way to accomplish this.

How Can You Verify Bank Accounts Using An API?

A set of instructions and protocols known as an application programming interface (API) enables two programs to communicate with one another. This implies that they can interchange information and capabilities without needing to independently create them.

As a result, you can get information about any bank account by using a bank account validator API and entering the account number. By doing so, you can find out more about it and determine whether it’s true or not. Additionally, an API streamlines and expedites the process of confirming bank accounts. Once you’re done, you’ll have all the information you require in your hands. It just takes a few seconds.

The financial services market is evolving. A digital transformation strategy has been developed by every successful bank in response to the demanding online and mobile services from informed clients. Typically, a major component of this strategy is an Open Banking initiative with APIs.

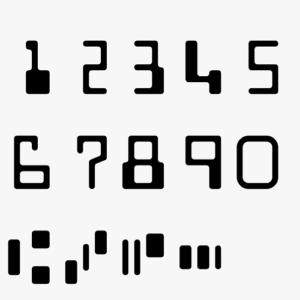

A routing number, a nine-digit identity, is used to identify a bank or credit union during a transaction. It intends to accelerate and reorganize banking sector operations. Each bank has been given a distinct number. Banks can be identified from one another while having the same names because of their unique routing numbers. This is the rationale for our decision to launch the state-of-the-art Routing Number Bank Lookup API today.

Routing Number Bank Lookup API

Given the aforementioned information, Zyla Labs’ Routing Number Bank Lookup API is an excellent addition to your company. Your business can maximize time and resources by implementing this API. You can automate the process of verifying routing numbers to locate a bank account and generate trustworthy financial transactions.

You may check your provider’s route number thanks to the integration of this API. Before doing any transactions, you can use this Routing Transit Number API. The bank to whom the routing number belongs can also be ascertained. The location of the account will be known as a result. Accessible information about the bank is available. Finding out more about the bank will also provide you the opportunity to get in touch with them and double-check everything. Using a bank information API will help your company stay current in the era of digital banking. It’s possible to improve customer service while while facilitating safe transactions and taking ACH payments. Wire transfers also work well with the Zyla Labs APIs that were previously described.