Do you require access to your customers’ bank account numbers? To find out how to use an API, see this post.

In Europe, identifying bank accounts is done using the International Bank Account Number (IBAN). It’s employed to identify the owner of a bank account, the bank, and the account number. It is a special identifying number that is acknowledged throughout the world and can include up to 34 alphanumeric characters. Money transfers within the European Economic Area (EEA) and between the EEA and nations outside the area both use the IBAN.

You can send or receive payments internationally using a code called IBAN, or International Bank Account Number. The only purpose of your IBAN code is to assist foreign banks in recognizing your bank account so you can receive or send international payments. It is distinct from your account and sort number. Your IBAN code contains many numeric identifiers that let foreign banks know your true bank and bank account, like a bank account number and country code.

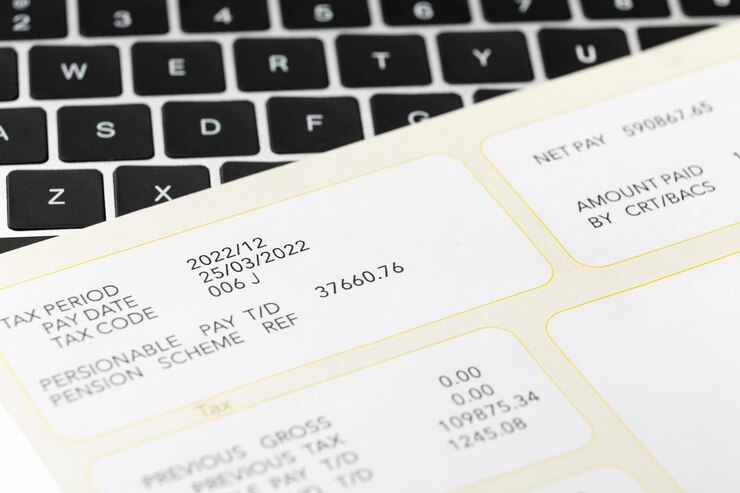

All transfers now take place using the IBAN, both inside Europe and between Europe and other nations, including non-European nations. In addition, it is utilized for all electronic transactions both inside and outside of Europe. When a customer opens an account, they supply the IBAN. Without requiring any further information from the client, the customer’s bank may at any moment supply this information. However, if you are in control of a business and require access to the bank accounts of your customers, you must ask them for this information.

So, you should use an API to find out where your clients’ bank accounts are located. Software technologies called APIs enable communication between two programs. Programmers utilize them in this way to integrate various services into their own platforms or applications.

What is a financial API?

There are various types of APIs used in the financial sector. In order to provide investors with information and enable them to make quicker, more educated trading decisions, brokerage APIs are used to collect data on the stock and cryptocurrency markets.

People can connect their bank accounts to financial services with the aid of another type of financial API, frequently referred to as “banking APIs” or “open banking APIs.” By enabling the development of new apps and services using safe and secure connections to bank account data, these financial APIs offer up a new world of financial access.

Peer-to-peer lending marketplaces, used car payment platforms, industry-leading rewards platforms, and countless more financial services can be created using financial APIs.

Routing Number Bank Lookup API

The Routing Number Bank Lookup API was developed by Zyla Labs and gives users access to bank information. These may comprise information like the bank’s name, account number, location, and more. The use of this bank information API streamlines bank-to-bank money transfers. Once you’ve chosen your preferred payment option and entered your routing number, the system will provide you all the bank information. Before completing the transaction, you can use this API to check the routing number, account location, and other bank information. Other than the 100,000 monthly request cap for individual plans, this ACH Bank Information API is unrestricted. But by switching to a customized plan, this problem can be resolved.

Lookup a bank’s information based on a routing number input. Choose either ACH or wire transfer bank information. It supports XML and JSON responses.