Taxes are necessary for all countries, but at the same time, they can be complicated, especially if you don’t have the right tools to help you. That’s why we recommend you to use a tax API. In this article, we will explain what is a tax API and which is the best one available in the market.

Taxes are an important element of most people’s lives. You must pay taxes on your earnings whether you are an employee or self-employed. In addition, if you operate a business, you must pay taxes on your profits.

What Is A Tax API?

An Application Programming Interface, or API in short, is software that allows two different programs to communicate with each other. This means that they can receive data from each other and use it.

Tax APIs are a kind of API that allows you to receive data about taxes. Tax APIs are a valuable tool for those who need to get information about taxes. They are especially useful for developers who want to create applications that help people with their taxes. Also, they are great for people who want to get more information about their own taxes.

And of course, they are essential for all the countries that need to receive information from other countries about taxes. The way these APIs work is by providing an interface where you can input the necessary information and then receive it in a simple way.

This way you won’t have to do any hard work, but still, get all the information you need. There are different kinds of APIs depending on the type of information they provide. But if you want to know more about tax APIs, we recommend you use the get tax rates and Number ID API.

Use This API To Simplify The Way You Pay Taxes

Get Tax Rates and Number IDs API is a powerful tool that will simplify your way of paying taxes. The API will allow you to get all the information you need about your income tax, VAT tax, and more.

Also, it works in almost any country in the world, so it will be useful for you no matter where you live! The best part about this API is that it is simple and easy to use. You just need an account and then you can start using it right away in a free trial! So don’t waste any more time and start using Taxes By State API today!

To make use of it, you must first:

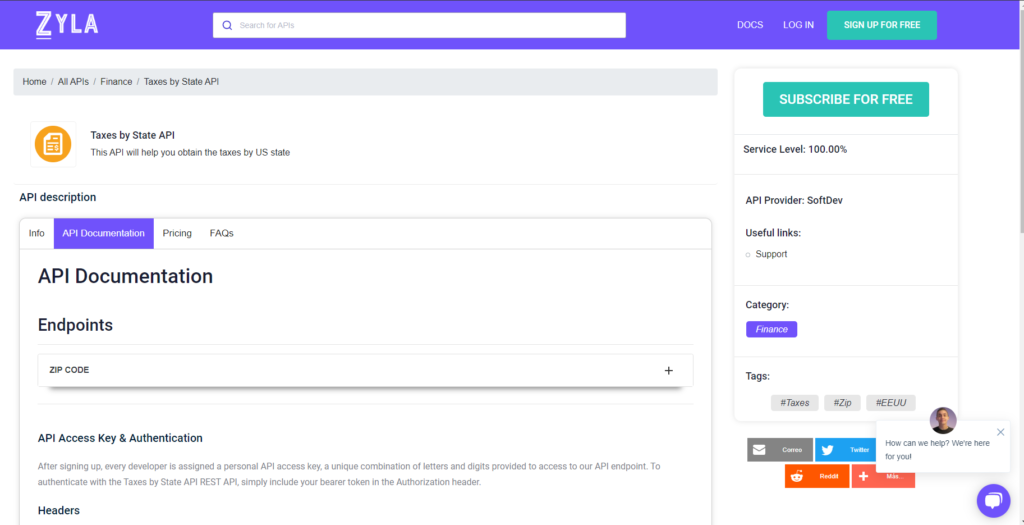

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

Related Post: How A Tax API Helps Your Business