Do you wonder what are the benefits of using a tax API? In this article we’ll show you three reasons that’ll make you want to use one.

The Internal Revenue Service (IRS) is the tax collection system for the United States. To collect the required taxes, the IRS uses a system of tax returns that are filed annually by each taxpayer. The institution then uses the information in these tax returns to determine how much percentage of tax each citizen owes to the state. Taxes are collected on a yearly basis.

To ensure that all taxpayers pay their required taxes, the IRS uses a system of laws, regulations, and policies to ensure that everyone pays their share. Paying taxes is an obligation and responsibility of every law-abiding citizen of a country.Taxes help the state provide necessary public services and finance research and defense likewise.

In modern times, many have started using tax APIs as tools that allow them to automate the calculations often done by accountants. API or Application Programming Interface technology can be used to create systems that provide information about different types of data; for this case, taxes.

Why Should I Use A Tax API?

Using a tax API is beneficial since it allows you to quickly access a great amount of useful info on tax calculation. It can basically speed up and reduce the time and effort you make to get your tax report correctly. If you’re someone with a business it can even be more beneficial.

So, if everything about a Tax API is so great then how can I start using one? For that, I’d highly recommend you to get the great and fine The Taxes API. This is a simple yet effective API which can give precise and good data on tax estimates and amounts.

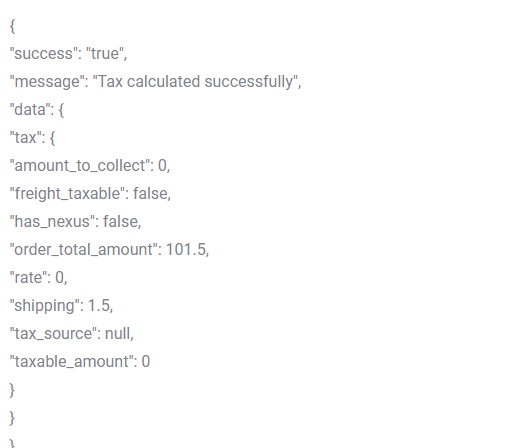

The Taxes API works with an input-to-endpoint method. For this, you provide data related to your country, state, zip-code and other required details. Based on this, the API returns you a JSON response which shows you the calculation of tax and amount to collect.

Which Are 3 Reasons To Use An API For Taxes?

There is no doubt that an API for taxes like The Taxes API can really be beneficial for most, but, what are the exact reasons that someone like you could need one really? Well, to put it simply, just read as follows; here are three reasons that will make you think about using a Tax API.

First: The use of The Taxes API does not extend to only common people. As mentioned, business owners can use it to help with their financial performance. Furthermore, real-estate agencies can even find uses in the services of the API.

Second: Although most people can do their taxes the right way, it still boils down to a dull and stressing task to do, even with years of experience. So, to help you save up some time being angry, you can use The Taxes API to just get all the data you need in a flash.

Third: The site offers great options to enhance the experience via the upgrade plans. These allow you to make more calls which will help you check out details easier and faster. The prices of the site are quite affordable and can be made with any popular credit or debit card.

Get to The Taxes API now, sign up your account and start accessing useful tax data in just seconds!

Don’t miss out on this great related post: A Taxes API To Know Your Tax Situation