Are you looking for the best API to protect your transactions? Then, this article is for you because we have the perfect API for you!

When it comes to online shopping, most people are aware of the risks of fraudulent credit card usage. In today’s e-commerce space, it’s more important than ever to ensure that customers are protected from fraud and malicious behavior. One way to ensure the safety of your customers is to use a credit card validator API. A credit card validator API is a web-based application programming interface (API) that checks the validity of credit card numbers.

A credit card validator works by cross-checking information about the cardholder, such as the name, address, and expiration date. The API also verifies that the card is valid and not expired. This API is useful for businesses that accept credit cards for payments because it helps to protect their customers from fraudulent charges. Using a credit card validator API can help to protect your business from costly chargebacks and other fraudulent activity.

By verifying the accuracy of customers’ credit card information, you can minimize the risk of fraud and fraudulent charges. You can also reduce the amount of time it takes to process payments since the API will automatically check the validity of the credit card information. In addition to protecting your customers, a credit card validator API can also help you improve your customer experience. By verifying credit card

What is a BIN validator API?

The next six digits are known as the “card number” or “account number” and they uniquely identify the account holder’s account with the issuing bank or financial institution.

This API is intended to help you spot fraudulent credit card transactions. Start verifying, validating, and checking all information on credit/debit cards just using BIN numbers.

What this API receives and what your API provides?

The user will send the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number) to get the full details.

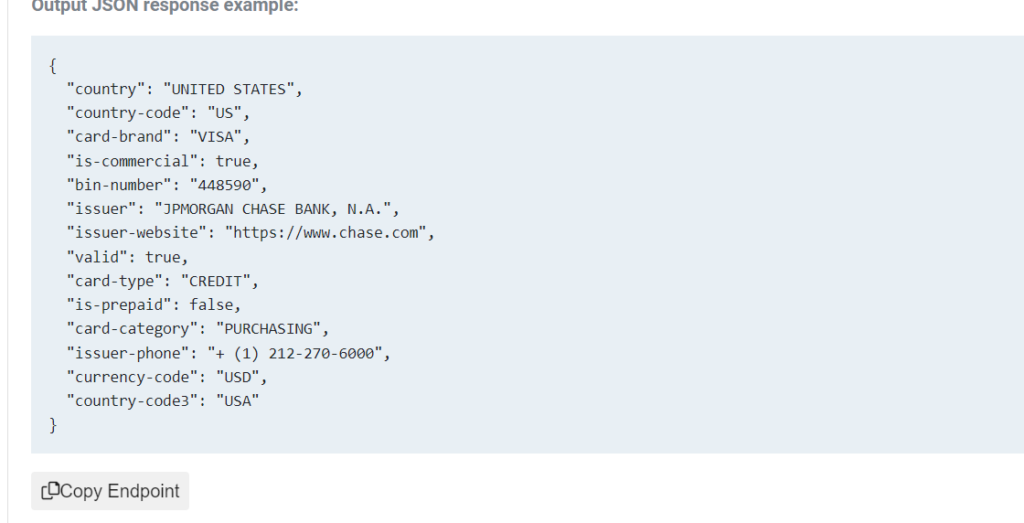

You have to provide a BIN (Bank Identification Number) – the first 6 digits of a credit/debit card, to receive the full details of this BIN/IIN in JSON format.

You will receive the card’s validity if it’s VISA or MASTERCARD, what is the issuing bank, and the card’s issuing location. The API gives to you a response like this:

What are the most common uses cases of this API?

This API is ideal for those who are wanting to implement a payments gateway on their pages. This API will help those purposes because it will recognize if the card is invalid.

This is also helpful to recognize the issuing bank or entity. So if you have special offers with a specific bank you will be able to authorize the transaction or not.

To make use of it, you must first:

1- Go to Credit Card Validator – BIN Checker API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen