If you are in need of a good tax API to help simplify your tax process, you are in the right place. Keep reading to find out more about the best API for your tax process.

Taxes are a necessary evil that we all have to deal with at some point in our lives. Whether you are an employee paying taxes to your government, or a business owner paying taxes on your company’s profits. Either way, paying taxes can be a tedious and time-consuming process.

Luckily, there are ways to make this process easier for you. One of these ways is by using a tax API. A tax API is a program that allows you to easily retrieve tax information from the government. This can include things like income tax, property tax, sales tax, and more.

Tax APIs can make the process of organizing taxes much simpler and easier for you. They can help you automatically calculate the taxes you owe, as well as help you file your taxes quickly and easily.

Why Should I Use A Tax API?

There are many reasons why you should use a tax API. First of all, using a tax API can save you a lot of time and effort. Instead of having to manually calculate your taxes, a tax API can do this for you automatically. This can save you a lot of time and effort, which you can use for other things.

Also, using a tax API can help ensure that you get your taxes filed correctly. With a tax API, you can be sure that your taxes are being filed correctly and accurately. This can help reduce the chance that you will have to pay any penalties or fines later on.

Finally, using a tax API can help save you money. By using a tax API, you will be able to avoid making any mistakes when filing your taxes. This can help ensure that you don’t have to pay any unnecessary fees or penalties.

So if you are looking for a way to simplify your tax process, we recommend using Tax Data API. Tax Data API is a simple and easy-to-use API that will allow you to quickly and easily retrieve tax information for any state in the United States. Tax Data API is also very easy to use and understand, so it is perfect for anyone who needs to retrieve tax information.

How To Get Started With Tax Data API

Tax Data API is an easy-to-use and powerful tool that will allow you to quickly and easily retrieve tax information for any state in the United States. This means that if you’re looking for a way to simplify your tax process, Tax Data API is the perfect solution for you.

To get started with Tax Data API, all you need to do is sign up for an account and then create an API key. With this key, you’ll be able to make calls to the Tax Data API endpoint; which allows you to make requests for data on income taxes, sales taxes, property taxes; as well as other types of taxes.

Once you’ve created your account and received your unique API key; all you need to do is include your bearer token in the Authorization header when making an API request.

And voila! You’re done! Now go ahead and start simplifying your tax process with Tax Data API.

To make use of it, you must first:

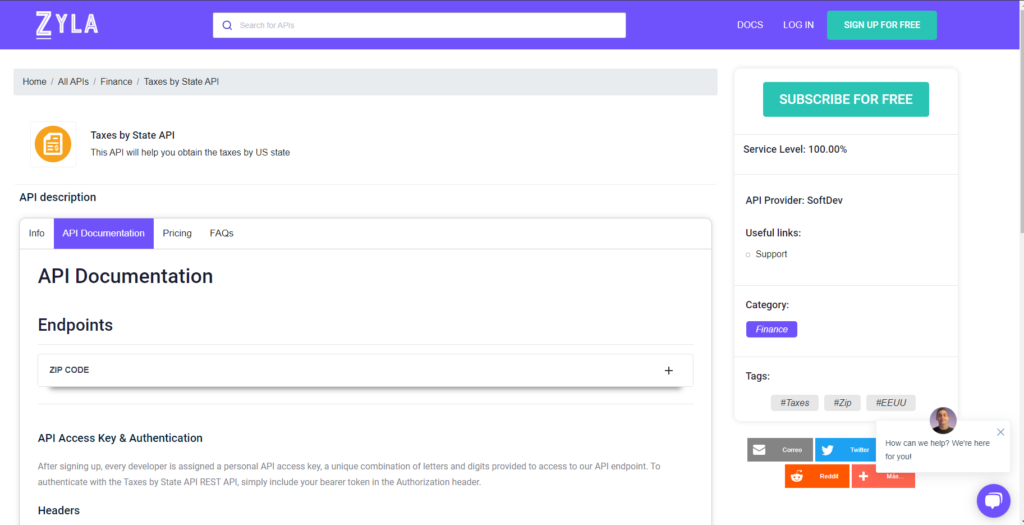

1- Go to Taxes by State API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

If you found this post interesting and want to know more; keep reading at Using A Taxes By State API To Simplify Your Tax Workflow