Staying ahead of the curve in today’s fast-changing economic climate necessitates access to precise and up-to-date information. Inflation is a key indicator that influences economic decisions and analyses. Understanding how prices change over time allows firms, regulators, and investors to make more informed decisions, minimize risks, and capitalize on opportunities. This is where the Monetary Inflation Index API comes in, providing customers with monthly and yearly inflation rates that are correct.

The Monetary Inflation Index API influences how we interpret and evaluate economic movements. Researchers, economists, central banks, investors, and enterprises can utilize the capabilities of this API to dig into the complex realm of inflation rates. The API’s simple interface and rich documentation make it easy to integrate into a variety of applications and systems. To provide a thorough picture of economic price variations, it includes a wide range of businesses, including food, housing, transportation, health, and energy. Customers may use the API to navigate the volatile economic climate and make informed decisions based on reliable inflation figures, whether for economic research, monetary policy decisions, investment strategy design, corporate planning, or risk management.

What Does An API Use To Calculate The Inflation Rate?

The API that calculates total inflation incorporates data from a variety of economic sectors, including food, housing, transportation, health, and energy. Using statistical approaches, the overall inflation rate is computed by aggregating price increases across industries. The method used varies according to the company or institution providing the API, but it usually comprises tracking the price movements of a basket of items and services that are representative of average consumer expenditure.

The API takes into account price variations in a range of commodities over specific periods, which are frequently monthly or yearly. The API calculates the inflation rate by looking at price changes, which are percentage increases in the average price level of goods and services during a certain period.

Because of thorough data collection and comprehensive coverage of various areas of the economy, the API’s overall inflation rate is accurate and dependable. This approach provides a comprehensive view of pricing levels and may be used in economic research, decision-making, and risk management.

Which API Provides The Best Inflation Rate?

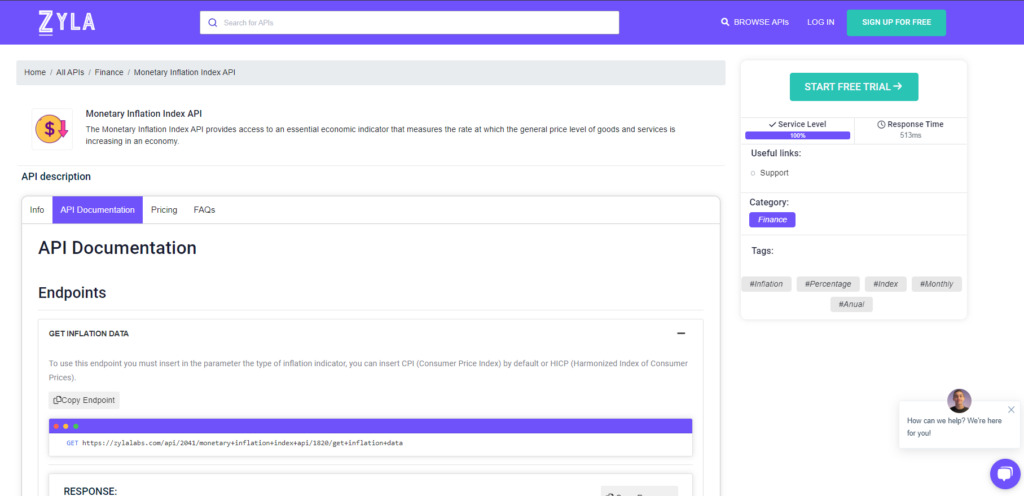

Following extensive testing, we can certainly claim that the Zylalabs API is the most user-friendly and produces the best results: Monetary Inflation Index API

In addition, the findings are delivered in JSON format!

Entering CPI (Consumer Price Index) or HICP (Harmonized Index of Consumer Prices) into the “Get Inflation Data” endpoint, for example, results in the following:

[

{

"country": "Canada",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 0.708,

"yearly_rate_pct": 4.406

},

{

"country": "Chile",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 0.312,

"yearly_rate_pct": 9.907

},

{

"country": "China",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": -0.194,

"yearly_rate_pct": 0.097

},

{

"country": "Czech Republic",

"type": "CPI",

"period": "march 2023",

"monthly_rate_pct": 0.136,

"yearly_rate_pct": 14.965

},

{

"country": "Denmark",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 0.256,

"yearly_rate_pct": 5.282

},

{

]

Where Can I Find The Inflation Rate API?

- To get started, navigate to the Monetary Inflation Index API and click the “START FREE TRIAL” button.

- You will be able to use the API after joining Zyla API Hub!

- Utilize the API endpoint.

- Then, by pressing the “test endpoint” button, you may make an API request and see the results shown on the screen.

Related Post: How To Acquire U.S. Inflation Data With An API